|

Since the first Presidential Debate, there has been a lot of hue and cry because Donald Trump had the temerity to declare that he paid no income taxes. More specifically Hillary Clinton said, about his refusal to make his income tax statements public:

Trump retorted, "That makes me smart," more or less declaring he didn't pay any income taxes and he's proud of it. And so he should be. To be sure, he is vulnerable to the charge of hypocrisy, not paying tax, on one hand, and advocating what could turn out to be the largest infrastructure project in American history on the other, in addition to kvetching about crumbling infrastructure and declining military spending. Yet, on the matter of taxes alone, he is right. Judge Learned Hand stated that "anyone may arrange his affairs so that his taxes shall be as low as possible; he is not bound to choose that pattern which best pays the treasury. There is not even a patriotic duty to increase one's taxes. Over and over again the Courts have said that there is nothing sinister in so arranging affairs as to keep taxes as low as possible. Everyone does it, rich and poor alike and all do right, for nobody owes any public duty to pay more than the law demands." (Gregory v. Helvering 69 F.2d 809 - 1935) Ironically, that judgment went against the taxpayer, something not often noted by those who quote it. The issue is known as the doctrine of substance over form. In that particular case, a businesswoman named Evelyn Gregory had swapped assets between two corporations, then dissolved one of them which distributed the assets to her as owner. She then claimed a lower tax liability as a result. In an analysis of Hand's contribution to tax law, Yale law professor Marvin Chirelstein notes that the courts "follow no single and consistent set of rules in deciding when to accept and when to disregard the taxpayer's choice of form" and that when the courts reject the citizen's chosen form of organization, they "commonly assert as a matter of principle that the incidence of taxation depends upon the substance of a transaction and that mere form is not controlling." But if the form is accepted, Hand's maxim reigns - "There is nothing sinister in so arranging affairs as to keep taxes as low as possible." That is why many businesses hire tax attorneys to advise them of the best options available to them.This results in a contradictory position. "In practice the first principle means simply that the range of effective choice is limited in the situation under review, or indeed that the only route to the taxpayer's destination is the one that bears the highest tax. By contrast the second principle, when applicable, confirms that the availability of alternative legal procedures also gives the taxpayer a right of election with respect to the tax consequences." What this means is that tax law is inconclusive and vague, but there's no harm in trying to keep taxes low. That is why many businesses hire tax attorneys to advise them of the best options available to them. Everyone Should Do It This is not just a privilege of the rich, though they might have more options available and the means to hire skilled tax lawyers. Every citizen has options available so as to limit or lower her taxes. These include such things as the various Individual Retirement Plans (IRAs) which confer certain tax advantages. Additionally, interest paid on a loan for business purposes is tax deductible. Many people run small businesses from their homes in order to deduct some of their living expenses. A recent article in the New York Times looking at the Trump tax imbroglio notes that tax write-offs for start-up business ventures are generous. "There was a point when even ruinous projects like an unfinished, unleased office tower could end up producing a profit for some investors, thanks to ample tax write-offs." Such loopholes, the article notes, were largely closed off for outside investors when the Reagan administration overhauled the tax act in 1986. "But active real estate investors and developers were allowed to keep that tax break." The article notes that when Trump had to disclose his tax filings to get a casino license back in the 80s, there were two years, 1978 and 1979, in which Trump paid no income taxes at all. "By taking advantage of deductions available to real estate developers and claiming losses from partnerships, Mr. Trump reported a “negative income” of $406,379 in 1978 and $3.4 million in 1979 — thus avoiding any tax liability for those two years, a time when he claimed to be worth hundreds of millions of dollars." The article notes further that Trump paid no income taxes in 1984, 1991 and 1993. The Donald was losing money on his Atlantic City casinos in those latter years which would have put him under water. But that is what entrepreneurship is all about. You take risks, including the risk of loss. And during the losing years, you pay no taxes. That is not, despite the agitations of the professional teeth gnashers, a bad thing. Nor is it shady or underhanded or in any way blameworthy. The Widespread Demand to Pay as Little as Possible We recently visited friends who live in a gated community on Vancouver Island. It's a fairly wealthy strata community and our host told us about one neighbor who boasts that he pays no income tax. I was amazed as I pay some tax even on my pension income. I wondered how he did it. But thinking about it, I can think of many ways in which a retired person with substantial assets can have a decent income and pay no income tax at all. These are options open to all my fellow Canadians who have accumulated some wealth during their working lives. If they have a beef, it should be with the governments making those tax laws, not with people and businesses making reasonable business decisions.These include Tax Free Savings Accounts (similar to Roth IRAs in the United States), reverse mortgages, remortgaging properties and so on. There is no capital gains tax in Canada on your principal residence. So if you bought a house in Vancouver for under $50,000 forty years ago which is worth over a million today, you can sell it and pocket that million bucks tax free. It's all above board and legal. Corporations often use differences in jurisdictional tax laws to avoid taxes by having subsidiaries in other countries. Ireland, for example, has some of the lowest corporate tax rates in the world and some companies use Irish subsidiaries to avoid paying American taxes. The professional crying in their soupers, of course, think this is a dastardly thing. But again, these companies are making use of existing legislation to minimize their tax liabilities. What's wrong with that? If they have a beef, it should be with the governments making those tax laws, not with people and businesses making reasonable business decisions. Indeed, Ireland gives generous tax benefits to creative artists. You can earn up to fifty thousand euros tax free if you live there if you are a cultural worker – a writer, a composer or a sculptor. No one seems to object to that but they cry a river when corporations use advantageous tax laws in other jurisdictions. Loopholes Liberate Tax avoidance is as American as apple pie.Like Clinton in the debate, the professional whinging class like to spout off all the things that the taxes would buy if only Trump or businesses or you and me were sacrificially minded enough. Clinton said, "So if he's paid zero, that means zero for troops, zero for vets, zero for schools or health." A site denouncing the Irish tax haven says America's three largest tech giants have avoided $8 billion over the years, money that could have paid for health insurance for 4 million kids, salaries for 200,000 teachers or pay for the California highway patrol for four years. A recent meme from Occupy Democrats says not paying taxes makes Trump, not smart, but "a selfish unpatriotic crook". Even the Clintons use trusts and charities that they control to minimize taxes. And what's wrong with that? Nothing. Remember that America was founded to a large extent on a tax revolt - the Boston tea party. Tax avoidance is as American as apple pie. The holier than thou types should consider again Judge Hand's words. "There is (no) patriotic duty to increase one's taxes. Over and over again the Courts have said that there is nothing sinister in so arranging affairs as to keep taxes as low as possible. Everyone does it, rich and poor alike and all do right, for nobody owes any public duty to pay more than the law demands." Amen to that!

Marco den OudenMarco den Ouden writes at The Jolly Libertarian. This article was originally published on FEE.org. Read the original article. More from LibertyLOL:

0 Comments

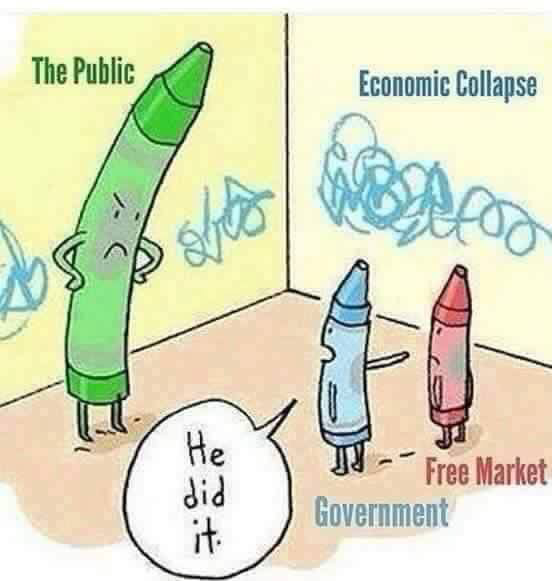

For those who understand free markets and The Federal Reserve's impact on our future economy and money supply it was exciting when Trump started railing against The Fed during last nights debate. We all waited for him to really hammer the point home. Then he didnt. Watch his response to Clinton at 2:14 below.

Yeah, he just kinda faded there at the end too.

He didn't even say "Federal Reserve"; he just kept mentioning the Fed. He really needed to spell it out for an electorate that is highly unqualified to even know what they are voting for or against. Simplify Donald. Here's what you should have said: "Look, you want to know why you can't get ahead!? This entire game, it's rigged against you. There's this Federal Reserve that isn't Federal at all. It's a private company. It's a cartel. It's cozy with politicians and cozy with banks and it prints free money so the banks can lend it out. That's right, free money so the banks can make money off something they get for free. The biggest tax you can ever imagine is when inflation hits you the little guy. Your money isn't as valuable as it used to be and it's the Federal Reserves' money policies continued by lousy lifelong politicians. Don't take my word for it. Go research. Go read The Creature from Jekyll Island. It'll blow your mind and you'll never vote for a lifelong politician again." -what Donald Trump should have said. #messaging There is a messaging problem here but Liberty is one of the easiest ideas to sell. (Not that I expect the Donald to be the standard bearer of Liberty, that's our job) It it all starts with knowledge, though. We can't be beholden to the news media's narrative and their biased headlines for knowledge. Quite the opposite, in fact. More from LibertyLOL:One year ago, Donald Trump thrust his bizarre, erratic, and incomprehensible campaign on the world. Much has been said about Trump’s "rhetoric" during his campaign — the racism, sexism, incivility, and much else besides — but rhetoric is not what makes a Trump administration a unique threat to the country. It is his policy proposals that should receive our closest attention and concern. Below is a list of nearly 60 “policies,” if you can dignify them with such a title, that Trump has proposed during his campaign. The list drives home how truly frightening a Trump presidency would be for the country and the world. Skimming the surface of Trump’s stream of consciousness brings out some particularly disturbing aspects of his agenda: notably, the way he singles out specific businesses and individuals for targeting by the government, as well as his obsessions with China, Mexico, Muslims, and immigrants. Perhaps worst of all, Trump’s proposals expose how broad he thinks the powers of the presidency are: virtually infinite. There is never a glimmer of understanding that the government is bound by the Constitution, that the federal government has limited scope and authority, or that president is just one of three equal branches of the federal government. Instead, it is Trump, and Trump alone, who will transform American laws, government, and society, from the top down. Trump will bomb and invade countries, Trump will steal their oil, Trump will kill deserters, torture suspects, bypass courts, ban Muslims, break treaties, and have the military do things like mass executions with bullets dipped in pigs' blood — all while getting Americans to say “Merry Christmas” again. Well, all I can say is Merry Christmas, America. Here's what the primaries brought us this year. Bold: attack on individual or business. June 2015

David J. BierDavid Bier is a policy expert in Washington, DC. This article was originally published on FEE.org. Read the original article. When testifying in 2010 before the Financial Crisis Inquiry Commission into the financial crash, then Federal Reserve Board Chairman Ben Bernanke recommended only one reference, Lords of Finance: The Bankers Who Broke the World (2009), presumably for the narrative that insufficient money-printing in the aftermath of the Great War lead to the next one. Right idea, wrong narrative! The US homeownership rate peaked at a rate well above the current level almost a half century ago, mostly funded by a system of private mutual savings banks and savings and loans. The historical justification for federal “secondary market” agencies was political expediency – exemption from now-obsolete federal, state, and local laws and regulations inhibiting a national banking and mortgage market. Now government-run enterprises account for about 90% of all mortgages, with the Fed as their primary funding mechanism – what the Economist recently labeled a de facto nationalization. The Historical Evolution How did the private US housing finance system repeatedly go bankrupt? To quote Hemingway: gradually, then suddenly.How did the private US housing finance system repeatedly go bankrupt? To quote Hemingway: Gradually, then suddenly. The two competing political narratives of the cause of financial market crises remain at the extremes – either a private market or public political failure – with diametrically opposite policy prescriptions. The politician-exonerating market failure narrative has, not surprisingly, dominated policy, with past compromises contributing to the systemic financial system failure, the global recession of 2008, and subsequent nationalization. The Great Depression stressed the S&L system, but the industry’s vigorous opposition to both federal deposit insurance and the Fannie Mae secondary market proved prescient as the federally chartered savings and loan industry eventually succumbed by 1980 to the federal deposit insurer’s perverse politically imposed mandate of funding fixed-rate mortgages with short-term deposits and competition from the government-sponsored enterprises. The S&Ls were largely replaced by the commercial banks. To make banks competitive with Fannie and Freddie, politicians and regulators allowed virtually the same extreme leverage, in return for a comparable low-income lending mandate – CRA requirements leading to a market-dominating $4 trillion in commitments to community groups, to whom the Clinton Administration had granted virtual veto power over new branch and merger authority. The Financial Crisis of 2008 and the Aftermath The Big Short by Michael Lewis, and the more recent movie by the same title, portrayed not just banker greed, but the extreme frustration of those shorting the US mortgage market, stymied by a housing price bubble many times greater than any in recorded US history that refused to burst. The reasons: 1. The Fed kept rates low and money plentiful, and 2. Whereas banks would have run out of funding capacity, the ability of Fannie and Freddie to continuously borrow at the Treasury’s cost of funds – regardless of risk and their HUD Mission Regulator requirement to maintain a 50% market share – kept the bubble inflating to systemic proportions. The Obama Administration fully embraced the alternative private market failure narrative in Fed policy, regulation, and legislation:

The Long-Term Consequences Bernanke’s focus on choosing the narrative was useful, but the political choice of the market failure narrative appears to reflect convenience rather than conviction. The direct taxpayer costs of implicit or explicit public insurance and guarantees come with both a whimper – tax savings amounting to tens of billions annually due to the deductibility of interest costs – and a bang – future taxpayer bailouts generally delivered off-budget. The student loan market has also been de facto nationalized.Fannie and Freddie conservatorship deftly avoided debt consolidation while dividends reduced reported federal deficits. The student loan market has also been de facto nationalized, with potential unbudgeted losses totaling hundreds of billions. Obamacare was similarly premised on regulating private health insurers to make health insurance simultaneously cheaper and more widely available, but under-budgeted health insurance subsidies predictably caused massive losses, and health insurers are now withdrawing from the market. Monetary policies caused household savings to stagnate as returns to retirement savings evaporated. Defined obligation public pension funds are all rendered technically insolvent when funding is valued at current market returns, rather than the assumed rate as much as ten times that. The failure of the economy to grow per capita was explained as the “new normal.” But politicians made no attempt to reflect the implied, technically insolvency of public pensions or Social Security and Medicare. Private firms fail, but private markets rarely do. Public protection and regulation makes firms “too big to fail” until markets fail systemically. The current and projected future public debt bubble is unsustainable, and financial markets will eventually ignore the accounting deceptions and pop it. The relative weakness of other sovereign debt is delaying the inevitable, making The Really Big Short a good title for a Michael Lewis sequel. Politicians and central bankers will again say “nobody saw this coming.” What then?

Kevin VillaniKevin Villani, chief economist at Freddie Mac from 1982 to 1985, is a principal of University Financial Associates. He has held senior government positions, been affiliated with nine universities, and served as CFO and director of several companies. He recently published Occupy Pennsylvania Avenue on the political origins of the sub-prime lending bubble and aftermath. This article was originally published on FEE.org. Read the original article. The student loan market has also been de facto nationalized.

More from Libertylol:

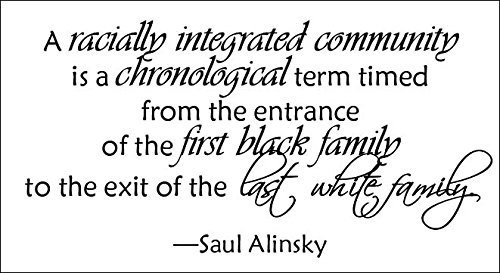

I was first interested in Rules for Radicals when I saw the image above. This is exactly what we have seen over the past 40 years so I decided to read the book. I wanted to be able to better identify when its strategy was used against the American people. Also, I wanted you to save ten hours of your life. You're welcome. Main salient points to follow:

So how do we combat this effective progressive agitation? Our first weapon is information. Call it out when we see it. Call out the immoral tactics. Call out the abuse of inaccurately creating social problems. Call out the divisive nature of media and government along social, racial, class and religious lines. Call out biased news reporting and holding the 4th branch of government accountable to facts and logic. If you want to read more, check out Barack Obama's Rules for Revolution by David Horowitz below. Also Six Alinsky Rules That Explain Obama’s Words and Deeds located here.

More from LibertyLOL:

Central Bank Failure

Since the Brexit vote, panicking Central Banks have flooded the world with more money in attempt to stabilize the financial system. Over thirteen trillion dollars of bonds around the world are yielding negative interest rates, which means nearly 30% of all worldwide government debt is at negative rates. This is a historical first. I believe that the policy of the money kings of the global central banks is starting to fail. Over the last ten years, the United States has averaged 1.8% GDP growth, the worst in US history. The only success the Federal Reserve and other Central Bankers can point to is an artificially high stock market. Underneath the glow of record highs lies a ticking time bomb of over-extended consumers, decreased industrial production, European-banking problems, Brexit, a massive debt bubble in China, ISIS, deflation and a contentious US presidential election. If there is a recession in the United States, the Federal Reserve will have a very difficult time cutting rates. It is this reason that a Fed rate hike could be in the cards. It would at least give The Fed some room to maneuver back down if recession strikes. The Fed should have raised rates over two years ago. At zero rates leading into a recession, The Fed only really has three options: fiscal spending, deregulation or currency depreciation. Fiscal spending has been an emphasized topic from both US Presidential candidates, particularly infrastructure spending in the United States. Both candidates agree that the United States has lacked infrastructure spending and is in need of a big build-out. This will be one of the big themes in the stock market over the next couple of years. One positive aspect about potential infrastructure spending is that current record low interest rates allow for cheap borrowing. I believe we should require infrastructure bonds to be established as mortgage bonds that pay down the debt at the end. This will eliminate the open-ended borrowing where debt spirals even higher. Instead the projects will be paid off in thirty years just like a home. The final way for a central bank to control inflation at zero interest rates is currency depreciation. I am expecting a major currency problem in the next 6-18 months that will likely lead to higher inflation. Evidence of the transition from deflation to inflation appears as central banks overplay their hand and currencies begin to fall. Over time, this will be good for gold and hard assets. Aspin Speech Long time readers of the MaxOut Savings Report know that I believe Stanley Fischer, the Vice Chairman of the Federal Reserve, is the most respected member of the Fed. Over the weekend, Fischer delivered an influential speech at the Aspin Institute laying out some important points on US economic standing. First, he made the case that over the last two years the United States has weathered a number of economic shocks. The events in China, a 20% rise in dollar value, and the Brexit vote have had little effect on the US economy and the labor market. I believe this could translate to a more hands off Fed. The next time the stock market falls, don’t expect the Fed to rush in and talk it up. Regarding negative interest rates Fischer stated that it is “something that the Fed has no plans to introduce”. That was a clear statement. Stanley Fischer also commented on the “exceptionally slow labor productivity growth….Business productivity growth is reported to have declined for the last three quarters, its worst performance since 1979”. Negative productivity is potentially a result of incorrect measurement or poor business investment. Stanley stated the key to boosting the productivity growth and long run potential of the economy is likely found in effective fiscal and “more-effective regulatory policy.” This statement hints the Federal Reserve is concerned that government regulation has become over reaching and is now negatively affecting economic growth. Regulatory Policy is an area that the United States can make tremendous headway. The beauty of deregulating the economy is in the resulting increase in growth and hiring. Deregulation and regulation efficiency are low cost compared to big ticket deficits such as tax cuts and infrastructure spending. Remember deregulation will grow the economy at no cost!

Purchasing your Amazon items through this search box supports

libertyLOL and doesn't cost you a penny more at checkout! More from LibertyLOL:

Here's the audio of Tom getting the scoop on how you can prevent the IRS suing you. Interesting scam, hard to believe people would fall for it! I won't give away any spoilers...

I'll grant you: I'd rather be contacted by shysters pretending to be the IRS than by the actual IRS.

But it's still annoying. The other day I got a voicemail message saying that the IRS was filing suit against me for back taxes and that I needed to call right away if I wanted to straighten things out. This was an obvious scam for numerous reasons (the IRS doesn't sue you for back taxes, for one thing), but since I was on a long drive and had a little time on my hands, I figured I'd call and see what they'd try to pull. So I dialed the number, and a person with a thick Indian accent answered and identified himself as being with the IRS -- as if you ever get someone from the IRS on the phone that quickly. So I played along. After some preliminaries, the man identified himself as "Kevin Peterson." I pardoned myself for sounding insensitive, but I noted that he didn't sound like any Kevin Peterson I'd ever met. What was his real name? Pause. "You want to know my real name?" "Yes." "My real name is $%&@# you, a******." I gleefully shouted, "I win!" and hung up. The whole thing was so much fun that I called again. This time I let the guy (a different one) go through his whole spiel. Then I pointed out that the scenario he was describing, in which the IRS had supposedly conducted a secret audit, and on that basis was threatening to seize my house and bank accounts, was so obviously contrary to IRS operating procedure that I was the one who should be suing him. He got flustered and hung up. By an interesting coincidence, this guy was also named Kevin. This was too much fun. I called a third time. I asked if I could speak to someone who wasn't named Kevin. The person shuffled some papers and declared himself to be named "Stuart Connor." Yeah, he sure sounded like a Stuart Connor. This one opened the conversation by saying he was calling to get my lawyers' information in advance of the lawsuit. I was supposed to be trembling and begging for mercy, I assume, but instead I called his bluff and said, "Sure: Weichert and Gasper, in Topeka, Kansas. Would you like their number?" Obviously their number was the last thing in the world he wanted. He then proceeded to explain how much trouble I was in, and said the police were coming to my home in Topeka. You mean the home I recently vacated and moved 1100 miles away from? He replied that he'd just traced my location, and that the police were coming there. "Oh, really? Where did you trace me to?" He wouldn't say. I then told him his whole racket was awful: if you're going to scam people, at least make it plausible. He became angry with me and hung up. Unfortunately, I was in the car and didn't record these. But I thought: tomorrow I'll call yet again, using my podcasting equipment, and I'll record a few of these conversations for the show. They are priceless, my friends. The first half of today's episode deals with the controversy surrounding the price of EpiPens: doesn't this show the failure of the free market? In the second half, I take on the scammers. This ain't one to miss: http://www.tomwoods.com/729 -Tom Woods The entire episode can be heard here:

Purchasing your Amazon items through this search box supports

libertyLOL and doesn't cost you a penny more at checkout! More from LibertyLOL:

Just what the world needs: another worthless college degree.

Today the University of Iowa became the latest institution of higher (so-called) learning when it made the nonsense concept "social justice" into a degree program. In doing so it joined a growing number of universities offering such degrees, thereby giving left-wing students still greater opportunities to live in a bubble for four years, be confirmed in all their existing views, and not be troubled by dissenting voices. (Meanwhile, outright assaults on their worldview is what libertarians and conservatives can expect to find on college campuses.) What, pray tell, will people do with a "social justice" degree, except use their paychecks from Starbucks to pay off college debts for the rest of their lives? In the meantime, I'm going to help teach younger folks something actually useful. Save the date: on September 28, T.K. Coleman and Tom Woods are going to run a free, live video session on entrepreneurship for teens. I'll remind you as we get closer. As of June, I myself am the father of a teenager. And I sure don't want her ground up in the educational-unemployment complex. I'm sure you feel the same about your own children. So forget the social justice degree. Head over to my live session with T.K. Coleman on September 28, and we'll actually teach stuff that matters. In the meantime, here's the opposite of a social justice degree, where you can learn non-p.c. history and economics that would give the social justice crowd a collective heart attack: Salivating? The deal is hereby sweetened, with our coupons page. Tom Wood

Purchasing your Amazon items through this search box supports libertyLOL

and doesn't cost you a penny more at checkout! More From libertyLOL:

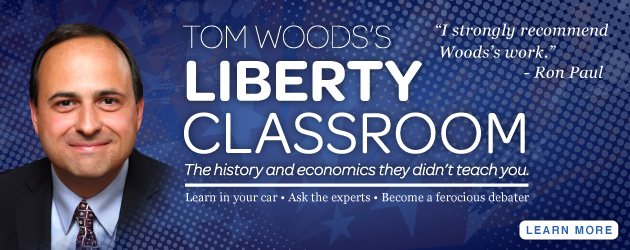

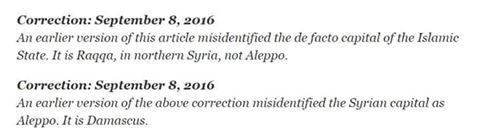

Gary Johnson has had his share of gaffes and un-Libertarian positions. Jason Stapleton explains why the Aleppo comment isn't as much a gaffe as a setup. And Jason is no supporter of Gary!

Episode Info

Then he made things worse by admitting he needs to "get smarter." It's rare that I find myself running to Gary Johnsons defense. Most of the time I find myself criticizing him, his comments and positions but this morning on Morning Joe, Gary was caught by Mike Barnicle in a gotcha question designed to trip him up. The question succeeded and Gary came off looking foolish. It could have happened to anyone and Gary could have done several things to mitigate the damage. Instead, he made the issue worse by opening his mouth again to reporters. I've got all the clips, and I'll go through all of it with you. This could be the nail that puts the Johnson/Weld coffin on the ground. I got an interesting link from a listener about a book claiming algorithms that determine sentencing and mortgage rates are racist. On its face this seems ridiculous but under close inspection, you discover that it is, in fact, ridiculous. I'll give you the whole story today. -Jason More from LibertyLOL:Lessons from the A-taco-lypseMarco Gutierrez unknowingly gave the best pitch for liberty last week—and he did so only using five words. During an interview with MSNBC, the founder of Latinos for Trump warned that if his candidate didn’t win in November, there would be “taco trucks on every corner.” This hypothetical taco truck bubble denotes another issue that is not being widely discussed. Obviously, Gutierrez intended to rattle the cages of nativists left and right—one side to call him racist, while the other can only seem to muster up dystopian platitudes about being “invaded by illegal immigrants.” But Gutierrez’s words backfired beautifully. Within seconds, #TacoTrucksOnEveryCorner was trending, and a vocal (and wildly humorous) majority of Americans gave a collective thumbs up to this compelling vision for the future. Unsurprising to those who mocked Gutierrez, the idea of taco trucks on every corner is very appealing. The most obvious issue raised by this conversation is immigration. However, this hypothetical taco truck bubble denotes another issue that is not being widely discussed: how local governments tend to restrict – rather than embrace – entrepreneurial trends, and unnecessarily insert themselves between consumers and businesses. The “Roach Coach” Renaissance Once derogatorily referred to as “roach coaches,” taco trucks have morphed into a diverse, eclectic, and highly profitable industry. In less than a decade, a growing army of foodie entrepreneurs – peddling mobile culinary treats once only available in traditional brick-and-mortar restaurants – have created an $800 million industry, and its popularity continues to grow by the day. This revolutionary business model has been widely embraced by consumers worldwide. We are, arguably, at our economy’s peak quantity of food trucks at this very moment. Yet, judging by the vociferous reaction to Gutierrez’s misguided “a-taco-lypse,” the current availability of food trucks isn’t enough; people are demanding more. Food trucks are a part of a broader pattern of entrepreneurship that jettisons traditional institutions, skirts around bureaucratic oversight, and provides an in-demand service or product directly to a very eager consumer base. With the advent of Uber, AirBnB, and a number of other cutting-edge businesses, this revolutionary business model has been widely embraced by consumers worldwide. Oddly enough, research indicates that these businesses produce a mass psychological perk as well, inspiring human engagement, promoting a broader sense of trust, and – in the words of NYU professor Arun Sundarajan – “reversing America’s decades-long slide into mass cynicism.” (This author in particular has discovered a direct correlation between his own happiness and proximity to tacos.) Local Government’s Motto: “When in Doubt, Tax, Regulate, or Ban it” Unfortunately, bypassing barriers of entry has produced unintended political costs on the backend. Political leaders and regulatory agencies are in a panic to retrofit existing policies that didn’t initially include these new businesses into their statutory calculations. The result of this panic: heavy-handed and obtuse rules that seem to be more about maintaining economic control than safeguarding a public good. AirBnB has faced relentless backlash from a variety of municipalities who want to register hosts, set size requirements for each shared space, and even mandate business licenses for participants. New York is currently debating a hefty series of fines for AirBnB hosts who “illegally” advertise restricted types of properties for rent with contract agreements shorter than 30 days. Meanwhile, Uber and Lyft have both faced significant pushback from local governments and taxi unions, demonstrating an obvious incestuous relationship between the two entities. The most glaring example of this collusion came in the form a per-ride tax imposed in Massachusetts, where revenue extracted from the ride-sharing industry directly subsidizes the failing taxi industry’s efforts to innovate and implement their own ride-sharing technology. These concerted efforts to rein in new companies highlight how “a very simple business model can become muddied when it meets real-world markets, and alters them,” writes Adam Chandler of The Atlantic. Ordinances? We Don’t Need No Stinkin’ Ordinances The same applies to the food truck movement and how they have disrupted local municipalities’ grip on economic planning. For example, food trucks have recently become a hotbed issue in Chicago. In 2012, the city passed a series of restrictions on the food truck industry – from how big their vehicles could be to how long they could do business in one physical location. Last month, the Chicago Sun-Times and local news affiliate ABC7 released a “damning” report that found that food truck operators were typically in violation of these ordinances and oversight was lax. (They say it like these are bad things.) Consumer behavior seems to support these maverick business practices. However, what’s missing from the journalistic investigation is any discussion of an incurred damage or perceived social ill created by the food truck industry. Are people getting sick from the food truck cuisine? What damages are caused by food trucks that remain in the same spot for three or four hours at a time? Other than breaking capricious and unenforceable rules, the perceived “lawlessness” of the Chicago food trucks does not demonstrate a significant liability to public safety. Global positioning devices are required on all Chicago food trucks, so local regulators can investigate operators who are violating the “two hour rule”, which mandates the food trucks cannot remain at the same physical location for this short and arbitrary timeframe. The Chicago Sun-Times/ABC7 report highlights the fact that many food trucks ignore the two-hour rule. The report quotes Emily Darland, a food truck owner in Chicago, who isn’t shy about her own brazen violation of this rule (and many others): “Nobody moves after two hours,” Darland said. “No one does. “The people making the rules have no idea what it’s like to be out here in business.” So where’s the crackdown on this food truck piracy? With so many food trucks in violation of the law, there must be good Samaritans snitching to local law enforcement about these lawless foodies, right? Not so much. In fact, consumer behavior seems to support these maverick business practices. For example, to warrant an investigation by the City of Chicago, complaints must be filed before regulators can pull GPS data on specific operators who might be staying beyond their two-hour window. Mika Stambaugh, a spokeswoman for the Business Affairs Department of the city government that oversees these ordinances, states, “We haven’t received enough complaints warranting a GPS search.” Food truck patrons apparently can’t talk on the phone with law enforcement when they are sporting a mouthful of savory Korean barbeque, Latin American paletas, deep-dish pizza, hot dogs with every imaginable garnishment, pretzel-bunned deli sandwich, or whatever unique food truck delicacy that are currently stuffing their mouths with at the moment. (If that last sentence didn’t make you drool, there are also food trucks that specialize in kale.) Envisioning the taco truck utopia elicits an age-old political motto: “think globally, act locally.” While supporting less restrictive immigration policies from their federal government, taco truck utopians must also turn their attention to the local ordinances that needlessly attempt (and often fail) to centrally plan industries that pose no immediate threat to the public at large. In other words, don’t tread on my taco trucks.

Jay StooksberryJay Stooksberry is a freelance writer with a passion for liberty, skepticism, humor, and whiskey. When he's not writing, he splits his time between marketing consultation and spending time with his wife and son. Follow him on Facebook and Twitter. This article was originally published on FEE.org. Read the original article. More from LibertyLOL: |

Search the

libertyLOL Archives: Archives

December 2020

Search and Shop on Amazon.com!

Tom Wood's Liberty Classroom"Get the equivalent of a Ph.D. in libertarian thought and free-market economics online for just 24 cents a day...."

At Liberty Classroom, you can learn real U.S. history, Western civilization, and free-market economics from professors you can trust. Short on time? No problem. You can learn in your car. Find out more! |