|

Here's something to consider regarding the U.S. economy.

The pace of job creation slowed dramatically in Obama's last year, and it slowed even more during Trump's first year. (I point this out to show that job creation generally has very little to do with a President's policies even though all Presidents will take credit for gains and blame someone else for losses.) These days, we are constantly bombarded with one politician or another claiming that his or her new policies, regulations, or tax plans will "create new jobs." Why should we renegotiate trade deals? "Create new jobs." Why should we cut taxes? "Create new jobs." And on and on.

While creating new jobs isn't a bad thing, of course, a lack of jobs also isn't a problem facing our economy right now. There are more than 5 million unfilled jobs in our economy--employers literally cannot fill them all. The problem, therefore, isn't too few jobs; rather, the problem is too few workers. There simply are not enough participants in our labor force to fill even those jobs that are currently available.

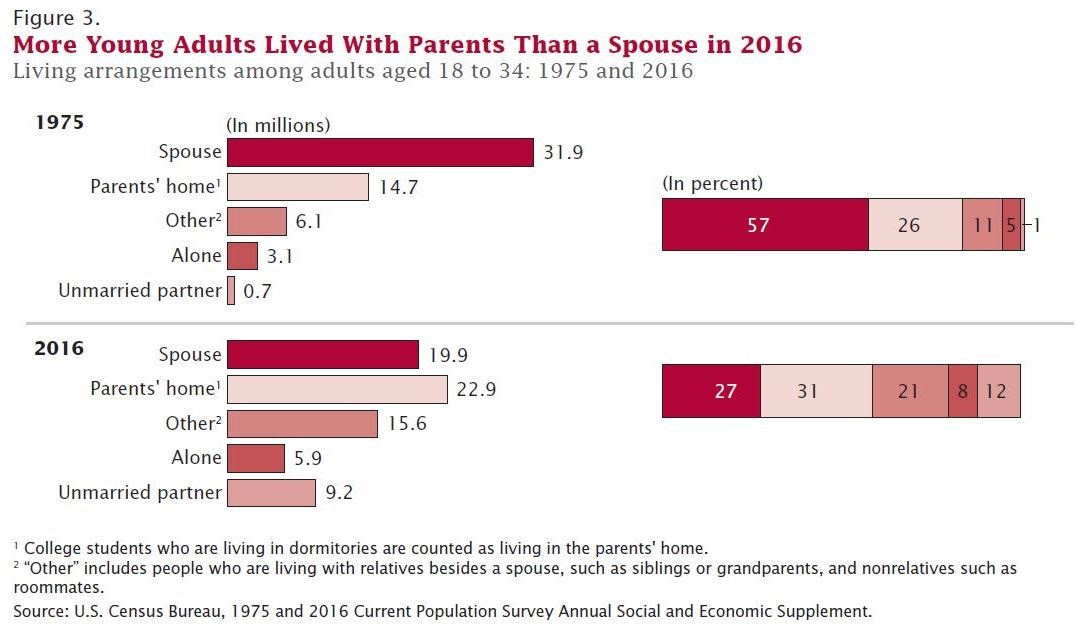

Cutting tax rates and reducing regulatory burdens are important (though spending should be cut as well in order to keep these things from piling up more debt for us), but these will not solve the labor force problem. What can we do then? One avenue is to enact policies that increase the labor force participation rate. This is frequently cited as one justification for the need to reform our welfare system. Indeed, our welfare system does need to be reformed: it is too expensive and does not do enough to encourage its recipients to reenter the workforce. That said, increasing the labor force participation rate is a short-term solution--a Band-Aid. Why? Because that means increasing the number of workers out of the population that currently exists. Therein lies the real problem: regardless of our labor force participation rate, the absolute size of our potential labor force is now shrinking. In order for the labor market to continue growing organically, each American woman must have MORE than 2.1 children. That hasn't been the case in this country in a long time, and as of today, each American woman has an average of only 1.5 children. That means that our organic labor force is shrinking--more and more older people and fewer and fewer younger people.

For a while now, the overall size of our labor force has been growing because of immigration. Americans no longer have enough babies to keep it growing, so we've used immigration to grow. Now immigration is quickly falling off as well, so not only will our labor force resume its overall shrinking, but our population as a whole will begin to shrink. This will mean slower economic growth (perhaps even stagnation eventually), lower government revenue, more debt (all else equal), and standards of living that either don't rise or that rise only very slowly.

If we want to lower our debt, increase our standard of living, increase the rate of economic growth, and increase government revenue without increasing tax rates, then we must ensure that our labor force continues to grow. (This is especially true when one considers how much larger China and India's labor forces are than our own, something that could give them a considerable advantage over us over the long term.) Thus, there really are only two types of policies that we should be pursuing to this end: those that encourage families to have more babies and those that encourage more immigration.* *Caveat: "More immigration" doesn't mean no-holds-barred, beat-down-the-borders immigration. It means tailoring immigration quotas annually to the needs of our economy and issuing visas based on these needs. Follow libertyLOL on your favorite social media sites:FacebookYoutube Tumblr Pintrest Countable: Government Made Simple Steemit blog on a blockchain Patreon Gab.ai libertyLOL's Liberty Blog RSS Feed We also run a couple twitterbots which provide great quotes and book suggestions: Murray Rothbard Suggests Tom Woods Suggests Jason Stapleton Suggests Progressive Contradictions MORE FROM LIBERTYLOL:

0 Comments

There's some good news and some bad news as we roll into Christmas vacation.

Since I like to end with good news whenever possible, I'll start with the bad.

The first topic I wanted to mention is the GOP tax plan. Actually, the news isn't all bad. For this one, it's both good and bad--a mixed bag. There are two parts to this: how the plan was constructed and the merits of the plan itself.

The way in which the plan was constructed is one of the universally negative aspects of the bill and is a prime example of how poorly Washington functions. The bill, whose partial initial purpose was to simplify our tax code, ballooned in a matter of weeks to nearly 500 pages and many hundreds of thousands of words. (So much for simplification, right?) On top of that, it was written entirely by Congressional Republicans. There was no attempt to reach across the aisle. There was no attempt to seek the CBO's input. In fact, the bill was thrown together so quickly that the CBO didn't have time to score it, most think tanks didn't get a chance to weigh in on the entire text, and members of Congress--Republicans--were admitting that they didn't have time to read much of it. This is a reform effort that will dramatically impact both our economy and our government's finances, and it appears to have been done in haste and without much due diligence. As evidence of this, consider what happened 20 December. Only after having voted for the bill did the House discover that portions of it violate Senate rules. Now the House will have to vote on it again on 21 December. Businesses don't run this way. Most Americans don't run their lives this way. Our government shouldn't run this way either. That said, the bill that emerged actually wasn't all bad. So what about its merits? First and foremost, it thoroughly overhauled our corporate tax system. It may well be the most significant corporate overhaul ever. Among other things, it reduced the corporate tax rate to 21% and switched the U.S. to a territorial rather than a global tax system. It created incentives for companies to bring cash back to our country too. This is universally a good thing. Our corporate income tax system was incredibly uncompetitive. Even with these major changes, we're not even close to the most competitive country out there. We're in the thick of the pack now though. These changes were long, long overdue. This will promote growth, increase the number of jobs, and could increase investment as well. (That part remains to be seen. There are good arguments both ways.) There were also substantial changes to the personal income tax system. This is where the both-good-and-bad part starts to come into the equation. There were many changes to the way that our personal income tax system works. For the first few years after the bill's passage, most Americans will see a very small reduction in their tax bills. That's where the good part ends though. Some Americans will actually have their tax burden increased. Even though their income tax rates may fall, the fact that so many deductions are being eliminated means that they may still end up having to pay more than they did before this bill (we're looking at you Californians). Even for those Americans who do experience a reduction, it is likely to be relatively small. After around 2020, almost half of Americans could actually be paying more in taxes than they would have under the "old" system. Unfortunately, the half of Americans who are having their tax burden increased are the half who earn the smaller amount of income. Those who earn more will get to keep their reduced burden for longer. By 2025, almost all of the personal income tax changes will then expire. That's right: The personal income tax deductions were not made permanent. They are temporary. This means that whether the personal income tax changes were a good or a bad thing isn't immediately obvious. Clearly most Americans would agree that having more money--even in one year--is good for them. There's quite a bit of evidence, however, that temporary tax cuts have very little impact on the economy, can create imbalances and even bubbles, and can even harm Americans who plan their budgets around their new tax rates only to find them shoot up again shortly thereafter. I believe that politicians at that time will just extend the tax cuts permanently (they are seeking reelection, after all). This will throw off all of the accounting tricks that make this bill ONLY cost an additional $1Trillion in debt... It will then cost more. On the whole, the bill makes a large number of necessary, long overdue changes. I can't shake the feeling that this was also an enormous missed opportunity though. The original goal of simplifying the tax code wasn't met. Both the corporate and individual codes remain as long and as complicated as they've ever been. On top of that, as I said, many of the bill's provisions are temporary anyway. This brings me to my last point and the one point that is unquestionably bad: Why are those provisions temporary? The short answer: They almost certainly had to be. This last point is my primary concern with the bill and is the only true reason that I question the wisdom of the bill as it is currently written. (There are ways to reform our tax code without piling trillions of dollars in additional debt onto our backs.) The previous sentence is the point: This bill adds a tremendous amount of new debt to our government. At an absolute minimum, it will add an additional nearly $500 billion to our national debt (according to The Tax Foundation). Most other analysis puts that total closer to $1 trillion or even $1.5 trillion. Bear in mind that that is debt above and beyond what we'd have already accumulated. We'll still be accumulating the "other" debt too. Republicans are now up against a harsh reality. They've campaigned for years on cutting the tax burden. For years--decades even--our government had a small enough debt load that we could easily have done this without significant adverse impact. The cold, hard reality now though is that we have such an enormous debt load (105% of GDP) that we're actually quite constrained in how much--and for how long--we can reduce people's tax burdens without causing government solvency problems. Thus, Republicans opted to have most of this tax bill's changes expire in less than a decade in order to slow the accumulation of debt.

FREE BITCOIN! When you buy $100 Bitcoin through this link, you'll earn $10 of FREE Bitcoin! (IMMEDIATE 10% ROI!)

This is why Republicans have actually added more to the national debt than Democrats have. We want to increase military spending, increase infrastructure spending, and keep welfare spending the same (apparently) but reduce the government's revenue. If that's what you plan to do, then there's only one way to fund it: more debt. In other words, young people today and people yet to be born are having their futures mortgaged. This is IMMORAL, even if it means we save 4% on our tax bills, personally.

After all of this new debt is accumulated, what will happen? Well, our rates will go right back up again. We'll be back where we started, only with a lot more debt. What, then, did we really accomplish for individuals? In all likelihood, we've hurt them over the long term for one reason. Mark my words: Our debt load is so large and growing so quickly, that bickering over the temporary nature of tax cuts will one day seem to be a luxury. Unless we get our fiscal house in order, we are only borrowing from people's futures. A day is coming when our tax rates will have to be RAISED in order to keep our government solvent. Eventually our debt will impose realities like that. This is what we are setting ourselves up for. The Republicans like to think that their tax cuts generate enough new growth to pay for themselves. The reality, of course, is that they don't. Even the most politically conservative analysis supports me on this. They do cause some additional growth, but they don't cause enough to fully pay for cuts, and they never have. Not a single tax cut package has ever fully paid for itself with new growth. That's why you must cut spending. Cutting spending is how you make the equation balance. We tell ourselves that our tax cuts mean that we don't have to cut spending because the lower tax rates will generate enough new growth to pay for themselves. This is only a psychological need: We tell ourselves this so that we feel better about the long-term problems we know that our debt accumulation will cause. We want to believe it. The problem is that it simply isn't true. (On a side note, we're likely to experience even less growth from this tax bill now than we would have a couple of decades ago when we first started talking about it because our labor force is now shrinking. Regardless of tax rates, there's only so much new growth that can be generated from a shrinking labor force. We don't have enough babies and now also discourage immigration. There isn't a third way to grow a population or a labor force over the long term.)

Anyway, I said that I'd end on a positive note, and I will. The new national security strategy that Trump announced yesterday is tremendous. It places additional emphasis on jihadist networks, as well it should. It shines a spotlight evermore directly at North Korea, as well it should.

The most important aspect is this though: It labeled China a "strategic competitor." You can bet that that is absolutely true. China is not a friend of the United States or of the global trade and sovereignty rules whereby the U.S.-led system operates. China sees themselves very much in competition with the U.S., and it's time we stepped up to the plate. China plays on a market field that has no foul lines. It's time for us to level that playing field. While many Americans are complaining about Mexico's impact on our economy (which, contrary to much of what is shared on Facebook, actually provides an enormous boost to our economy), China steals our long-term prosperity. When it comes to engaging with the rest of the world, China looks out for China first. Thus, when it comes to engaging China, we should look out for ourselves first. Sometimes diplomacy is called for, but most of the time you need to call something what it is. The era of holding China's hand and pretending that they're are our friend must end. China is a competitor that plays by its own rules at the expense of Americans' economic interests, and it's time for us to meet that challenge head on. I applaud Trump for making this change. It's time. Let's gear up and fight for our long-term economic wellbeing. Follow libertyLOL on your favorite social media sites:FacebookYoutube Tumblr Pintrest Countable: Government Made Simple Steemit blog on a blockchain Patreon Gab.ai libertyLOL's Liberty Blog RSS Feed We also run a couple twitterbots which provide great quotes and book suggestions: Murray Rothbard Suggests Tom Woods Suggests Jason Stapleton Suggests Progressive Contradictions MORE FROM LIBERTYLOL:

FREE BITCOIN! When you buy $100 Bitcoin through this link, you'll earn $10 of FREE Bitcoin! (IMMEDIATE 10% ROI!)

Do you trust "The Government" or "The Market" more?

I have no doubt that Comcast and other large Internet Service Providers do not have MY personal best interests in mind. Not exactly. They have this thing called 'profit motive'. But in a Free Market, if they continue to screw someone over or charge too high of prices, people will stop using their services and it’s an opportunity for another business to undercut them. They go out of business if they can’t offer the best product at the cheapest prices, because someone else will. Because "Profit Motive". There are entire YELP-like industries designed around measuring how well companies This entire Net Neutrality Debate is simplified in one question.Do you trust "The Government" or "The Market" more? This is the only question you need ask yourself. Let's discuss all these atrocities they are saying 'could occur'.... Why haven't we seen them from 1994-2014, twenty years with NO NET NEUTRALITY at all, and none of these horrors occurred. Sure some companies had some fights and guess what they all solved it and moved on. It never affected you for a moment, you didn't even know it happened until the TV or the great Facebook told you about it. The internet is the most awesome tech ever created, why?More than two decades to evolve free of regulation, that is why. Some are too young, you don't remember how regulation has always been the problem and never once been the solution. When phones were highly regulated, great screams poured out when deregulation was proposed. They said it would be 'suicide for our communication networks and capabilities'. "The corporations will charge you for every feature", "Long distance will triple!", "They will shut your phone off if you say something they don't like!", "they will tap your phone", on and on it went....any of this sound familiar? Jack Spirko reminds us what telephone service was like before DEREGULATION?

I’m talking about back in the good old days when it was highly regulated?

Here are some facts about that time...

The sheep are so easily led by a terms "net neutrality" and “free and open internet”, it all sounds so nice right?

It actually amounts to one thing "government regulation of the internet", every time you hear or read the term “net neutrality”, translate it in your head to read"government regulation of the internet" and see how much support you have for it in a week or two. Go check out these and other chunks of wisdom at The Survival Podcast.

But what about GEOGRAPHICALLY disparate communities with only one provider?!First research this: Why aren't there competing ISPs where you live? Does your local ISP have a monopoly that was granted to them from government regulation? Or does the cost of internet infrastructure truly outweigh the population in an area? If there is no incentive to bring a second company into such a small population, chock that up to your 'cost of living in the boonies." The argument that "Cheap Abundant Internet is a Right because everything we do is online" will be withheld for another time (it's not). There are never really any true monopolies, even Standard Oil would see competitors the moment they increased prices. The ‘out in the boonies’ problem you have can probably only be fixed with a US Postal Service-style monopoly. But then you’d be getting USPS Government quality Internet. The problem we have in this case (geographically, only one provider) is the kind of problem that the market corrects for, over time, though. It spurs the next innovation that will reduce the cost of DSL/Satellite solutions which will free us of the old physical fiber lines. Just think, the 'telephone poles' we are so accustomed to seeing in our neighborhoods are 99% obsolete for telephone connectivity these days. Who has telephones in their house anymore? Let the market innovate out of your problem. Yes, I know that means it sucks in the meantime. Final Thoughts

If the internet would be SO AWFUL without net neutrality why was it awesome from 1994-2014 when we had nothing even approaching "net neutrality" for those 20 years?

If it’s meant to help ‘the little guy’ compete with large media, then why is large media lobbying to get it passed? Could it possibly be that large media LOVES legislation that they can lobby for that helps them and hurts others? Could it be that large media firms can afford the teams of lawyers needed to comply with large regulation, knowing that the startup “little guy” can’t? Most people who hate big business these days don’t even understand that these big businesses have politicians in their pockets in order to protect their market share and protect them from the ‘little guy’ who can innovate to make things better and cheaper for us. Just think, if government started regulating the net in 1994, you'd still hear modem noises followed by "YOU'VE GOT MAIL" every time you logged on 23 years later! Thanks Free Market! Don't Fall for the Following Scare Tactics in Hopes Government can get Involved

|

Search the

libertyLOL Archives: Archives

December 2020

Search and Shop on Amazon.com!

Tom Wood's Liberty Classroom"Get the equivalent of a Ph.D. in libertarian thought and free-market economics online for just 24 cents a day...."

At Liberty Classroom, you can learn real U.S. history, Western civilization, and free-market economics from professors you can trust. Short on time? No problem. You can learn in your car. Find out more! |