|

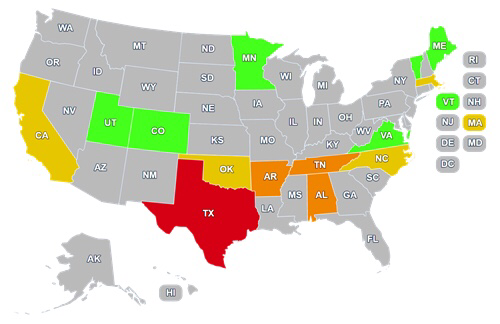

For 15 jurisdictions, today is your first chance to cast a vote in the 2020 presidential election. Of course, it’s not quite that easy if you are not supporting one of the two old parties. For Libertarians in these 14 states and American Samoa, the rules are not all the same. For some, participating in the primary will disqualify them from participating in their Libertarian convention process (heads up Texas, DO NOT VOTE IN THE PRIMARIES if you want to vote in your Libertarian convention). For other states, the convention process is done, and you can sit back today. (We’re talking about you Arkansas, Alabama, and Tennessee). Other states still have conventions coming up (so make sure you know the details, Colorado, Maine, Minnesota, Utah, Vermont and Virginia). Finally, some states do include Libertarians in the primaries and you can get out and vote today (hopefully you already knew this, California, Massachusetts, North Carolina, and Oklahoma).

Whether you are voting today, waiting for your state convention, or still trying to decide what to do, we’re here to help. In honor of the 15 different groups of voters trying to figure out what to do today, here are…

1. The Libertarian Party is the only anti-war party.

You cannot count on Democrats to end the wars — they have been every bit to blame as the Republicans. While in the midst of trying to impeach President Trump, a bi-partisan Congress approved a military budget of over $700 billion. Neither old party has any intention to ease up or end our military interactions. If you are ready for an America at Peace, it’s time to vote Libertarian. 2. The Libertarian Party is the only party committed to eliminating the national debt. Republicans have long been considered the anti-debt party, but that can only be laughed at now. After eight years of calling out President Obama’s reckless spending and increased deficits, they have been silent and/or outright supportive of Trump’s explosive spending that has taken our national debt from $19 trillion to $23 trillion in three years. If an annual deficit of $1 trillion dollars is unacceptable to you, your best move is to vote Libertarian. 3. The only way to stop more government overreach is to vote for the Libertarian Party. Increased taxation for “free” college is promised by the Democrats; tariffs (which are taxes) and bailouts are executed by Republicans. Both old parties are inching or running toward single-payer healthcare, more gun control and granting the executive branch more and more power. The only choice for those who care about personal and economic liberty, separate from the boot of big government, is the Libertarian party. 4. The only way to send a message to the ruling old parties is to vote for the Libertarian candidate. Once again, the only alternative party that will be on every ballot in the 2020 general election is the Libertarian Party. A vote for Trump sends the message that nothing needs to change. A vote for any of the Democratic candidates likely to get the nomination is a message that nothing they do needs to change either. We currently have more people choosing not to vote for anyone than to pick one of the options the Rs or Ds serve up, and that does nothing to wake up these power-hungry politicians. If your hope is to see better candidates coming from any party, the only way to send that message is to scare those who rule over us by voting Libertarian. 5. Libertarian policies benefit everyone, and they get adopted the more voters show support for such things. It seems hard to believe that the Democratic party was officially still against same-sex marriage less than a decade ago. The Libertarian Party has supported equal rights (and removing the government from marriage) since its founding in 1971. Both parties are still waffling on if people who chose to use cannabis for medical or recreational purposes should go to prison. Many states have changed their laws, while federally some lawmakers are looking to add vaping as a crime. The Libertarian party has supported individual liberty (and no victim, no crime) since its founding in 1971. The liberty movement does affect the public view of issues and eventually leads to better policies. If you want to see more Libertarian policies adopted by old party representatives, you show them that by voting Libertarian. 6. You don’t want to have to spend the next four years explaining why the dumpster fire you supported was not as bad as the dumpster fire someone else supported. Voting for the lesser of two evils is still attaching your name to something evil. It sucks. Don’t do it. Vote Libertarian. 7. Because you “Support the Troops”. Democrats and Republicans both like to act like they are moral patriots who value nothing more than the brave men and women who serve their county. Truth is, they are lying. If they really cared about the troops, they would never flippantly start a new war, they wouldn’t refuse to do their job to vote on military action, and they would certainly spend much more time talking about the 22 veterans a day who commit suicide. War is a failure on every level, and we fail our service men and women once they return home. Do you support the troops, really? So does the Libertarian Party. 8. Consistent Principles only exist in the Libertarian Party. We already mentioned the Democrats’ evolution on rights for gay people only when it became politically beneficial to them. Republicans say they support your Second Amendment rights, until Trump says we need to limit that a bit. Both old parties jump around on which personal decisions they will allow and which they will criminalize. In their histories, the ruling parties have changed their principles drastically. The Libertarian Party platform has held consistent values of individual liberty since it was first written in 1971. Do you want to know that the party you support is going to hold to the values you supported them for? Your party is the Libertarian Party. 9. The Libertarian Party supports ending harmful election laws and opening up the ballot for other parties too. Perhaps you feel that another party best represents your views, but they do not have ballot access. Republicans and Democrats write the very laws that keep alternative parties off the ballot or using all of their resources to get on the ballot. Libertarians believe the duopoly has to be defeated if we will ever see real and meaningful changes in this country. A vote for the Libertarian candidate is a vote for allowing more candidates and more parties of future ballots, and an end to the ruling parties ability to force you to choose between two terrible candidates. 10. The Libertarian Party is the most welcoming to immigrants and refugees. If you believe children should never, ever be separated from their parents and held in government custody for crossing a political border, you can be sure that the Libertarian Party agrees with you. Democrats and Republicans will continue to argue over miniscule changes - the Libertarian Party will end this insane and dysfunction humanitarian crisis by legalizing the free movement of peaceful people. 11. Because you do not want to live in a {insert religion here} theocracy. Libertarians believe that everyone should be able to hold faith and religion as important or irrelevant to their life as each chooses and that the government should never propose policies or laws based on the support or opposition of any religion. 12. To get money out of politics. It’s funny how often you hear Democrats talk about getting money out of politics, while they promise to pay for college, healthcare, retirement, childcare, and on and on. That is every bit “money in politics” as corporations and lobbyists writing huge checks. Libertarians want to return the executive branch to the limits our Founders intended — that means removing the authority to make such false promises, either to special interest groups or the general public. 13. You support Free Speech — for everyone. Both old parties will talk about their commitment to the First Amendment, but in practice, both have proven willingness to limit free speech that they do not appreciate or agree with. Libertarians believe that if you don’t support free speech for everyone then you don’t support free speech. 14. Reject Nationalism and Socialism with one vote. There are two broken ideologies threatening liberty in our nation today, and they are coming from both major parties. Reject the inhumanities we know come from these authoritarian philosophies, and support liberty instead. 15. Libertarians do not seek power - they seek a world set free. Republicans and Democrats continue to fight over which one best knows how you should live your life. Libertarians know that they best thing for individual humans is to be free to live their life without the approval of any political party. Can you think of anymore? No matter which one of these reasons rings the truest for you, remember that when you go to vote. Even if you are not voting today, you can still cast a vote for liberty, fiscal responsibility, human rights, and integrity by supporting the party of principle. We are proud and honored to be the voice for freedom in America today. Donate to the Libertarian Party Today! "Get the equivalent of a Ph.D. in libertarian thought and free-market economics online for just 24 cents a day." MORE FROM LIBERTYLOL:

0 Comments

My faith in humanity has been restored.

Typically, when you talk about politics on Facebook, your chances of getting cancer go up exponentially. It counter intuitive, actually. You'd think people would not go out of their way to publicly prove their political ignorance in such a public forum. But you'd be wrong. C-SPAN publicly asked it's followers a simple question, "Your ideas to streamline federal government?" I expected the common political drivel involving the use of force to punish your political enemies. Jail the Democrats, Jail the Republicans, etc. Instead they hit a vein that goes beyond Left-Right Politics. People want smaller government and government that is effective and not wasteful. For example: "Shut down 80% of the federal departments. Set up GoFundMe pages and allow people to give their dollars to programs they value, voluntarily." "Stop taxing us for more services than defense. The federal government's only job is to protect us from threats. Not buy up land, regulate business, hand out entitlements, etc. That is the state's job. Enact term limits and prosecute politicians when they commit felonies, espionage, etc. " "Pare back to just the essential duties outlined in the constitution, leave the rest to the states, and you'll reduce it by 75%." "Actually this is an idea stated in jest by Ben Shapiro, but I think it might work - bring our representatives and senators back home to their districts/states to actually live with their families/constituents and face the consequences of their decisions with those they are supposed to be representing. They can vote with an app. They do everything else with one. That would end hired lobbying, make the legislative branch, at least, truly accountable, and clean out the swamp big time" "Fire half the federal employees, do away with the Department of Education, the Energy Department, The Airport screeners. If you're working for the Federal Government and you're classified as non-essential you shouldn't be there!!!" "Pass a constitutional amendment that specifically says “The powers not delegated to the United States by the Constitution, nor prohibited by it to the States, are reserved to the States respectively, or to the people”. Oh wait never mind it’s already in the bill of rights. So let’s just follow the constitution then." "Get rid of 75% of the agencies, Dept of Education, BLM, EPA, etc. Cut back IRS and tax laws and make it an agency that provides tax advice and helps people know how to pay taxes, House and Senate have six months each year to get the job done (no lifetime salaries and benefits)...then they have to go home and are subject to the same laws and benefits all citizens have to live by. Supreme Court Justices must retire at the age of 75 or sooner if they fall asleep during hearings." "No more increases in military budget until the Pentagon can fully account for the trillions of dollars it has "lost". Congressional pay should be reduced to the average income of the state that each Representative and Senator represents. Drop all health care coverage for Senators and Representatives. Shutter ICE. End corporate welfare, using the savings to ensure solvency for both Social Security and Medicare. Oh, make it illegal for Senators and Representatives to work for lobbyists and enact term limits for Senators and Representatives (3 terms in Senate, 6 terms in the House)." "Stop the congressional lifetime pay check and benefits. (Congressional welfare...)They have all become millionaires....they don't need the lifetime pay check. Give some of that money to our disabled veterans." "The government has specific powers and duties under the constitution. Bring it back to the original purpose to serve the people. It was this way in its writing to prevent exactly what it has come to now, a cash cow of corruption to those in DC" "1. Congress passes a law making it illegal for federal employees to collectively bargain or lobby. Bureaucracies use political power to grow themselves. 2. Get rid of the federal retirement system and replace it with 401K or some other portable pension. High wages and early pensions draw slackers and keep non-performers and mediocre performers on the job. 3. Immediately cut 15% of federal positions. Agency directors and supervisors have no financial incentive to reduce payroll. Conversely, an easy way to currently justify a promotion in the federal system is to add subordinates, not to produce results. Forced to do the job with fewer employees, supervisors would be forced to get rid of the dead wood. 4, Substantial cash incentives paid to federal employees who discover ways to improve efficiency. 5. Congress passes balanced budget and creates law requiring all future budgets to balance. 6. Abolish Department of Education and return education management to states." "Eliminate all government pensions, move half of our military bases off foreign soil, make food stamps (EBT) only used for basic foods (ground meat, oatmeal, etc), simplify law (as opposed to exponentiation) and enforce diligently such as "run from the police in a motor vehicle: 5 years minimum in jail, privatize what is failing (ie schools, prisons), and legalize anything involving consent (drugs, prostitution, etc)." Faith in humanity restored, indeed! Follow libertyLOL on your favorite social media sites:FacebookYoutube Tumblr Pintrest Countable: Government Made Simple Steemit blog on a blockchain Patreon Gab.ai libertyLOL's Liberty Blog RSS Feed We also run a couple twitterbots which provide great quotes and book suggestions: Murray Rothbard Suggests Tom Woods Suggests Jason Stapleton Suggests Progressive Contradictions Taxation is Theft Bot

As I write this fat check to Uncle Sam, I've always wondered... What if elections were held immediately after we paid our tax bill every year?

What if taxes weren't withheld from everyone's paychecks every year and they had to come up with thousands each April? What if my tax bill was itemized every year? Rapper Cardi B famously noted that when she gives millions to private charities, she gets emails showing the schools she's helping to build and the kids she's assisting, why doesn't Uncle Sam? What if your tax bills were itemized? Of the XXX you owe: $251 goes to Egypt for foreign aid $14 goes for treadmills for shrimp $149 goes to govermental printing costs that could be avoided by changing font $110 goes to Air Force One for unofficial vacations $.48 on an unused monkey house $29 fraudulent tax reimbursements to prisoners $410 on 'improper payments' or fraudulent payments due to lack of financial controls $1.89 on a 3-week long FAA party $42 NSA and other gov't use of World of Warcraft as collections platform $4 U.S. Census commercial that appeared during the Super Bowl $.22 On a laundry-folding robot $17 On a study about baby names (and "The astounding conclusion: Popular names are popular with parents.") Do you think people would be more active in holding politicians/bureaucracy accountable?Who cares more about your money? You or the Government? Of course it's you. Looking at the list above, would you better invest that money in your life or are you glad it went to countries where they openly burn our flag? 50 Examples of Government Waste The six categories of wasteful and unnecessary spending are:

See also, 13 Silliest Uses of Taxpayer Money

Since you made it this far down the post, I'll let you in on a little secret. This 4th of July, we're going live with a new website www.Liberty.wiki. We're building out the infrastructure at the moment and learning wiki markup from scratch! Please bookmark it and, once up and running, contribute of your own free will, with an article or two on something that you're an expert at! Follow libertyLOL on your favorite social media sites:FacebookYoutube Tumblr Pintrest Countable: Government Made Simple Steemit blog on a blockchain Patreon Gab.ai libertyLOL's Liberty Blog RSS Feed We also run a couple twitterbots which provide great quotes and book suggestions: Murray Rothbard Suggests Tom Woods Suggests Jason Stapleton Suggests Progressive Contradictions Taxation is Theft Bot

FREE BITCOIN! When you buy $100 Bitcoin through this link, you'll earn $10 of FREE Bitcoin! (IMMEDIATE 10% ROI!)

There are many problems with cryptocurrencies. That is all starting to change.

One criticism of cryptocurrencies is their highly speculative nature which has a roller coaster effect on their market value. Extreme returns can be met with losses just as quickly. Determining the true value of a cryptocurrency is extremely difficult to ponder, especially if the crypto doesn't have any clear legitimate use in the real world. There are also barriers to entry in the public's adoption of cryptocurrencies. It takes savvy to understand blockchain technology, research and select an appropriate online wallet, use private posting keys, etc. It's amazing how few crypto-investors have ever even read a white paper. The Latium Platform solves for these valuation and these barriers of entry by creating an easy to use market place where anyone willing to complete a task is rewarded with LATX tokens based on smart contracts. Think of the emergence of the 'gig economy' since the recession of 2008. Services like Uber, Lyft, AirBNB, Fiver, Upwork and others have connected those who want services to those who can provide it worldwide. No longer is employment limited to a local or state employee pool. The Latium Team will be releasing the Alpha version of the Latium Platform Friday, December 29th, 2017. Even though many who aren't crypto-savvy won't be purchasing tokens outright, they will be able to create a Latium account and receive crypto from completing tasks. By implementing a smart contract-based, global reputation system, Latium aims to disrupt the multi-billion global labor market through the blockchain and make the employer-employee relationship more transparent.

The Latium platform can be used for task creation, meaning that anyone needing a task completed (logo design, ride-share, assassination) can now use LATX to pay for the labor. This gives LATX an intrinsic value within the system rather than the purely speculative value given to most cryptocurrencies and tokens.

This platform will also integrate a reputation system which will make the entire employee/employer relationship much more transparent while also filtering out spam and unwanted content. Of note, John McAfee, Founder of McAfee Anti-Virus, has joined the Latium team in an advisory role. I foresee a couple results in this use of blockchain technology. 1. Lower unemployment rate 2. Higher level of efficiency in output for platforms like social media sites and apps 3. Reduction in the rate of spamming in community driven platforms 4. Most importantly, the widespread adoption of LATX as it is more utilized in commerce by common-folk. Go check out Latium's platform and get in on their token sale while they are still offering bonuses! Follow libertyLOL on your favorite social media sites:FacebookYoutube Tumblr Pintrest Countable: Government Made Simple Steemit blog on a blockchain Patreon Gab.ai libertyLOL's Liberty Blog RSS Feed We also run a couple twitterbots which provide great quotes and book suggestions: Murray Rothbard Suggests Tom Woods Suggests Jason Stapleton Suggests Progressive Contradictions MORE FROM LIBERTYLOL:

There's some good news and some bad news as we roll into Christmas vacation.

Since I like to end with good news whenever possible, I'll start with the bad.

The first topic I wanted to mention is the GOP tax plan. Actually, the news isn't all bad. For this one, it's both good and bad--a mixed bag. There are two parts to this: how the plan was constructed and the merits of the plan itself.

The way in which the plan was constructed is one of the universally negative aspects of the bill and is a prime example of how poorly Washington functions. The bill, whose partial initial purpose was to simplify our tax code, ballooned in a matter of weeks to nearly 500 pages and many hundreds of thousands of words. (So much for simplification, right?) On top of that, it was written entirely by Congressional Republicans. There was no attempt to reach across the aisle. There was no attempt to seek the CBO's input. In fact, the bill was thrown together so quickly that the CBO didn't have time to score it, most think tanks didn't get a chance to weigh in on the entire text, and members of Congress--Republicans--were admitting that they didn't have time to read much of it. This is a reform effort that will dramatically impact both our economy and our government's finances, and it appears to have been done in haste and without much due diligence. As evidence of this, consider what happened 20 December. Only after having voted for the bill did the House discover that portions of it violate Senate rules. Now the House will have to vote on it again on 21 December. Businesses don't run this way. Most Americans don't run their lives this way. Our government shouldn't run this way either. That said, the bill that emerged actually wasn't all bad. So what about its merits? First and foremost, it thoroughly overhauled our corporate tax system. It may well be the most significant corporate overhaul ever. Among other things, it reduced the corporate tax rate to 21% and switched the U.S. to a territorial rather than a global tax system. It created incentives for companies to bring cash back to our country too. This is universally a good thing. Our corporate income tax system was incredibly uncompetitive. Even with these major changes, we're not even close to the most competitive country out there. We're in the thick of the pack now though. These changes were long, long overdue. This will promote growth, increase the number of jobs, and could increase investment as well. (That part remains to be seen. There are good arguments both ways.) There were also substantial changes to the personal income tax system. This is where the both-good-and-bad part starts to come into the equation. There were many changes to the way that our personal income tax system works. For the first few years after the bill's passage, most Americans will see a very small reduction in their tax bills. That's where the good part ends though. Some Americans will actually have their tax burden increased. Even though their income tax rates may fall, the fact that so many deductions are being eliminated means that they may still end up having to pay more than they did before this bill (we're looking at you Californians). Even for those Americans who do experience a reduction, it is likely to be relatively small. After around 2020, almost half of Americans could actually be paying more in taxes than they would have under the "old" system. Unfortunately, the half of Americans who are having their tax burden increased are the half who earn the smaller amount of income. Those who earn more will get to keep their reduced burden for longer. By 2025, almost all of the personal income tax changes will then expire. That's right: The personal income tax deductions were not made permanent. They are temporary. This means that whether the personal income tax changes were a good or a bad thing isn't immediately obvious. Clearly most Americans would agree that having more money--even in one year--is good for them. There's quite a bit of evidence, however, that temporary tax cuts have very little impact on the economy, can create imbalances and even bubbles, and can even harm Americans who plan their budgets around their new tax rates only to find them shoot up again shortly thereafter. I believe that politicians at that time will just extend the tax cuts permanently (they are seeking reelection, after all). This will throw off all of the accounting tricks that make this bill ONLY cost an additional $1Trillion in debt... It will then cost more. On the whole, the bill makes a large number of necessary, long overdue changes. I can't shake the feeling that this was also an enormous missed opportunity though. The original goal of simplifying the tax code wasn't met. Both the corporate and individual codes remain as long and as complicated as they've ever been. On top of that, as I said, many of the bill's provisions are temporary anyway. This brings me to my last point and the one point that is unquestionably bad: Why are those provisions temporary? The short answer: They almost certainly had to be. This last point is my primary concern with the bill and is the only true reason that I question the wisdom of the bill as it is currently written. (There are ways to reform our tax code without piling trillions of dollars in additional debt onto our backs.) The previous sentence is the point: This bill adds a tremendous amount of new debt to our government. At an absolute minimum, it will add an additional nearly $500 billion to our national debt (according to The Tax Foundation). Most other analysis puts that total closer to $1 trillion or even $1.5 trillion. Bear in mind that that is debt above and beyond what we'd have already accumulated. We'll still be accumulating the "other" debt too. Republicans are now up against a harsh reality. They've campaigned for years on cutting the tax burden. For years--decades even--our government had a small enough debt load that we could easily have done this without significant adverse impact. The cold, hard reality now though is that we have such an enormous debt load (105% of GDP) that we're actually quite constrained in how much--and for how long--we can reduce people's tax burdens without causing government solvency problems. Thus, Republicans opted to have most of this tax bill's changes expire in less than a decade in order to slow the accumulation of debt.

FREE BITCOIN! When you buy $100 Bitcoin through this link, you'll earn $10 of FREE Bitcoin! (IMMEDIATE 10% ROI!)

This is why Republicans have actually added more to the national debt than Democrats have. We want to increase military spending, increase infrastructure spending, and keep welfare spending the same (apparently) but reduce the government's revenue. If that's what you plan to do, then there's only one way to fund it: more debt. In other words, young people today and people yet to be born are having their futures mortgaged. This is IMMORAL, even if it means we save 4% on our tax bills, personally.

After all of this new debt is accumulated, what will happen? Well, our rates will go right back up again. We'll be back where we started, only with a lot more debt. What, then, did we really accomplish for individuals? In all likelihood, we've hurt them over the long term for one reason. Mark my words: Our debt load is so large and growing so quickly, that bickering over the temporary nature of tax cuts will one day seem to be a luxury. Unless we get our fiscal house in order, we are only borrowing from people's futures. A day is coming when our tax rates will have to be RAISED in order to keep our government solvent. Eventually our debt will impose realities like that. This is what we are setting ourselves up for. The Republicans like to think that their tax cuts generate enough new growth to pay for themselves. The reality, of course, is that they don't. Even the most politically conservative analysis supports me on this. They do cause some additional growth, but they don't cause enough to fully pay for cuts, and they never have. Not a single tax cut package has ever fully paid for itself with new growth. That's why you must cut spending. Cutting spending is how you make the equation balance. We tell ourselves that our tax cuts mean that we don't have to cut spending because the lower tax rates will generate enough new growth to pay for themselves. This is only a psychological need: We tell ourselves this so that we feel better about the long-term problems we know that our debt accumulation will cause. We want to believe it. The problem is that it simply isn't true. (On a side note, we're likely to experience even less growth from this tax bill now than we would have a couple of decades ago when we first started talking about it because our labor force is now shrinking. Regardless of tax rates, there's only so much new growth that can be generated from a shrinking labor force. We don't have enough babies and now also discourage immigration. There isn't a third way to grow a population or a labor force over the long term.)

Anyway, I said that I'd end on a positive note, and I will. The new national security strategy that Trump announced yesterday is tremendous. It places additional emphasis on jihadist networks, as well it should. It shines a spotlight evermore directly at North Korea, as well it should.

The most important aspect is this though: It labeled China a "strategic competitor." You can bet that that is absolutely true. China is not a friend of the United States or of the global trade and sovereignty rules whereby the U.S.-led system operates. China sees themselves very much in competition with the U.S., and it's time we stepped up to the plate. China plays on a market field that has no foul lines. It's time for us to level that playing field. While many Americans are complaining about Mexico's impact on our economy (which, contrary to much of what is shared on Facebook, actually provides an enormous boost to our economy), China steals our long-term prosperity. When it comes to engaging with the rest of the world, China looks out for China first. Thus, when it comes to engaging China, we should look out for ourselves first. Sometimes diplomacy is called for, but most of the time you need to call something what it is. The era of holding China's hand and pretending that they're are our friend must end. China is a competitor that plays by its own rules at the expense of Americans' economic interests, and it's time for us to meet that challenge head on. I applaud Trump for making this change. It's time. Let's gear up and fight for our long-term economic wellbeing. Follow libertyLOL on your favorite social media sites:FacebookYoutube Tumblr Pintrest Countable: Government Made Simple Steemit blog on a blockchain Patreon Gab.ai libertyLOL's Liberty Blog RSS Feed We also run a couple twitterbots which provide great quotes and book suggestions: Murray Rothbard Suggests Tom Woods Suggests Jason Stapleton Suggests Progressive Contradictions MORE FROM LIBERTYLOL:

FREE BITCOIN! When you buy $100 Bitcoin through this link, you'll earn $10 of FREE Bitcoin! (IMMEDIATE 10% ROI!)

The elections last night were, to be honest, a disaster for Republicans.

This should serve as a wake-up call to the GOP and to Republicans everywhere. There are two problems here. 1. Republicans like to campaign on fiscal responsibility, cutting spending and repealing ObamaCare. Once in power, we find it's business as usual. 2. There is now a remote possibility that these results were only a prelude of what's to come in the even more significant mid-term elections just one year from now. The problem isn't that we might have less Republicans (or conversely more Democrats). The problem is the messaging that will be shoved down our throats when Democrats begin to re-balance power back in their favor. "The People Have Spoken!" "Conservatives can't Govern!" "Single Payer for All!" Virginia used to be a largely conservative state. Then for many years, it was a reliable swing state. Now it is probably more a Democratic state than anything else (not solidly so--but still). The point: Virginia is continuing its long-term slide to the Left and won't be the last state to do so. As has been said many times, the Republican Party must think about their strategy and, crucially, about how they communicate with the public. It's a challenge for Google to find a time when Republicans actually reduced the size of government but that might be a starting point. Republicans cannot expect to overcome that challenge by doing the same things they've always done. They need to give serious thought to how we should be reaching out to voters in this day, time, and environment. For those of you who still support the Republican Party, I understand why your allegiance hasn't shifted to the Democratic Party. But when do you think the Republicans will start to represent you? At what point will you realize that reducing the size of government and reducing spending isn't going to happen? At this rate, I assume it's when we either a) hit $23 Trillion in Debt (2020) shortly followed by a Democratic President or b) $28 Trillion in debt (2024) and shortly followed by a Democratic President. At that point, it will be too late and the Republican Party will have to take a long look at itself and decide if it even holds limited government as a principle, or if it ever did. My worry is that, when the Republican Party goes through it's next soul-searching period, the Democratic Party (shortly to be the outwardly proclaimed "Socialist Party") will wreck havoc on this great country. Vote Libertarian in the meantime. Follow libertyLOL on your favorite social media sites:FacebookYoutube Tumblr Pintrest Countable: Government Made Simple Steemit blog on a blockchain Patreon Gab.ai libertyLOL's Liberty Blog RSS Feed We also run a couple twitterbots which provide great quotes and book suggestions: Murray Rothbard Suggests Tom Woods Suggests Jason Stapleton Suggests Progressive Contradictions MORE FROM LIBERTYLOL:

LIBERTARIAN BOOK CLUB: Organized Crime - The Unvarnished Truth About Government by Thomas DiLorenzo10/13/2017 We are a monthly book club for anyone who wants to learn more about Libertarianism. We will discuss each book's chapter/section in separate posts, so everyone will be able to read along at their own pace. We typically also focus on books which are available for free so that everyone can participate. Join the Private Facebook Group and follow us on Twitter as we seek to learn more about Libertarianism. Other books we've reviewed can be found here.

Organized Crime: The Unvarnished Truth About Government by Thomas DiLorenzo

Located here for free. Politics and thieves, coercion and regulation, fascism and the Fed, centralization and liberty, workers and unions, trade and freedom, free-market achievements and government disasters in American history — this book covers it all! Section 1: Coercion and Regulation I thought his synopsis and examples from Forty Centuries of Wage and Price Control: How NOT to Fight Inflation was solid. I’ll be adding it to my reading list. Unfortunately, no AudioBook version! The “DiLorenzo’s Laws of Government” are pretty solid. I’ll need to expound on them later in a longer article and have them somewhere where I can share them easier when I’m arguing with people who want bigger government. They resounded with me as I think they will with others. • DiLorenzo’s First Law of Government- In government, failure is success. Welfare Bureaucracy, Government Schools, NASA tragedies and the Federal Reserve, etc. • DiLorenzo’s Second Law of Government- Politicians will rarely, if ever, assume responsibility for any of the problems that they cause with bad policies. • DiLorenzo’s Third Law of Government- With few exceptions, politicians are habitual liars. • DiLorenzo’s Fourth Law of Government- Politicians will only take the advice of their legions of academic advisers if the advice promises to increase the state’s power, wealth, and influence even if the politicians know that the advice is bad for the rest of society. I also agreed that the price control section was timely after the debate we just endured following Hurricane Irma. I've written EXTENSIVELY about it here on my Steemit blog. How is it that The Continental Congress wisely adopted an anti-price control resolution on June 4, 1778 but it's still up for debate the negative effects? That Resolution read: “Whereas it hath been found by experience that limitations upon the prices of commodities are not only ineffectual for the purpose proposed, but likewise productive of very evil consequences—resolved, that it be recommended to the several states to repeal or suspend all laws limiting, regulating or restraining the price of any Article.” If they knew price controls always failed 240 years ago, why is it even a question today? I blame education, or lack thereof. Chapter 3 Who Will Regulate the Regulators The logic on ‘providing more power to the Fed in order to prevent another Great Recession” was spot on: “One of the biggest governmental lies is that financial markets are unregulated and in dire need of more central planning by government. Laissez-faire is said to have caused the “Great Recession.” Fed bureaucrats have lobbied for some kind of Super Regulatory Authority to supposedly remedy this problem. Th is is all a lie because according to one of the Fed’s own publications (“The Federal Reserve System: Purposes and Functions”), the Fed already has “supervisory and regulatory authority” over the following partial list of activities: bank holding companies, state-chartered banks, foreign branches of member banks, edge and agreement corporations, U.S. state-licensed bank branches, agencies and representative offices of foreign banks, nonbanking activities of foreign banks, national banks, savings banks, nonbank subsidiaries of bank holding companies, thrift holding companies, financial reporting procedures of banks, accounting policies of banks, business “continuity” in case of economic emergencies, consumer protection laws, securities dealings of banks, information technology used by banks, foreign investment by banks, foreign lending by banks, branch banking, bank mergers and acquisitions, who may own a bank, capital “adequacy standards,” extensions of credit for the purchase of securities, equal opportunity lending, mortgage disclosure information, reserve requirements, electronic funds transfers, interbank liabilities, Community Reinvestment Act sub-prime lending “demands,” all international banking operations, consumer leasing, privacy of consumer financial information, payments on demand deposits, “fair credit” reporting, transactions between member banks and their affiliates, truth in lending, and truth in savings.” I had never heard of the non-profit libertarian think tank Competitive Enterprise Institute nor its annual product Ten Thousand Commandments: An Annual Snapshot of the Federal Regulatory State. It outlines the annual effect of regulations on business in the United States. Just checking out the fact sheet was valuable. As someone who thinks government spending and the national debt are keystone issues of our time, I also want to check out Underground Government: The Off-Budget Public Sector, his book written with James Bennett in 1983. Maybe we can get that book into the hopper for the Book Club! Chapter 5: Our Totalitarian Regulatory Bureaucracy “In chapter 5 of F.A. Hayek’s 1944 classic, Th e Road to Serfdom, the Nobel laureate warned that the state need not directly control all or even most of the means of production to exert totalitarian control over the economic life of a nation. He cited the example of Germany where, as of 1928, “the central and local authorities directly control 53 percent” of the German economy. In addition to this, wrote Hayek, private industry in Germany was so heavily regulated that the state indirectly controlled “almost the whole economic life of the nation.” It was through such totalitarian controls that Germany traveled down “the road to serfdom.” As Hayek further stated, “there is, then scarcely an individual end which is not dependent for its achievement on the action of the state, and the ‘social scale of values’ which guides the state’s action must embrace practically all individual ends.” In other words, government regulation was so pervasive that the pursuit of profit, driven by consumer preferences, was mostly replaced by the whims of regulatory bureaucrats.” Well Said: “First, construct a totally unrealistic theory of “perfect” competition that assumes away all real-world competition with assumptions of perfect information, homogenous products and prices, free or costless entry and exit from industry, and “many” firms. Second, compare real-world markets to this utopian Nirvana state and condemn the markets as “imperfect” or “failed. The third characteristic of market failure theories is to recommend intervention by presumably perfect government that is assumed to suffer from no failures and which will correct the failures of the market.” When I read that, it reminded me of this. Section 2 I read DiLorenzo's Real Lincoln which I highly recommend. I like how in chapter nine he describes Rod Blogajevich as an amateur crook compared to Honest Abe. It is not just a matter of businesses contributing to campaigns to get political favors but politicians using threat of regulations to extort contributions. Chapter 11 Good point on the housing bubble: “So when the Fed’s expansionary monetary policy caused the real estate bubble, the extraordinary increases in property values were accompanied by equally extraordinary property tax increases. (After the bubble had burst, local governments were eager to raise property tax rates so as not to lose property tax revenue." Chapter 12 “A principle of public choice economics is that politicians will always do all they can to disguise subsidies to less-than-meritorious groups, such as millionaire corporate farmers. If they can subsidize them through protectionism, or price supports, this is much preferred than simply writing the millionaire businessman a check.” Chapter 13 He discusses Hamilton and I recommend the Tom Woods vs Michael Malice debate (in which I side with Tom. Chapter 15 He expands a bit on the idea he expressed earlier of why exactly mainstream media is so pro-government. Section 3 I agree with DiLorenzo that secession, nullification, decentralization and localism is more effective at achieving liberty than nationalism or universalism, but it is important to understand, “Of course “states” don’t have rights; only individuals do." Since he understands that I think it is confusing that he keeps using the phrase. I definitely agree with him that repeal of the seventeenth amendment would greatly improve our situation. But that that seems highly unlikely to ever happen. Chapter 17 The Virginia and Kentucky Resolutions. I read this short book a few years ago and highly recommend it. Reclaiming the American Revolution: The Kentucky and Virgina Resolutions and their Legacy

Chapter 21

“The Lacrosse, Wisconsin Democrat newspaper advocate assassination when it editorialized in November of 1864 that “If Abraham Lincoln should be reelected for another term of four years of such wretched administration, we hope that a bold hand will be found to plunge the dagger into the tyrant’s heart for the public welfare.” (Does that violate the NAP?) Chapter 22 DiLorenzo basically says that Abraham Lincoln and Adolph Hitler were brothers from another mother. Chapter 23 He points out that governments are by far the worst killers in history and that in that regard Abraham Lincoln was worse than Pol Pot. Chapter 25 DiLorenzo eviscerates Paul Krugman, which is always fun. “Krugman is right about democracy in a sense: Democracy is essentially one big organized act of bullying whereby a larger group bullies a smaller group in order to plunder it with taxes. The “Civil War” proved that whenever a smaller group has finally had enough, and attempts to leave the game, the larger group will resort to anything—even the mass murder of hundreds of thousands and the bombing and burning of entire cities—to get its way.”

FREE BITCOIN! When you buy $100 Bitcoin through this link, you'll earn $10 of FREE Bitcoin! (IMMEDIATE 10% ROI!)

Chapter 26 and 27 In these chapters he does still more debunking of the Lincoln mythology. I did notice though that he doesn't claim that the War of Northern Aggression was an unmitigated evil - just mostly evil with terrible consequences, but he does acknowledge that the abolition of slavery was the one positive outcome of the war. He also discusses how American government is both fascist and socialist. Chapter 30 – 33 These chapters are all about the evils of central banking. I agree completely and have nothing to add except that coincidentally yesterday, before reading chapter 30, I used a very similar article by DiLorenzo to counter a commenter on this post who was saying that all economists think the Fed is great and that basically Ron is a crank. That post and Brion's book should be of interest to anyone who liked that chapter. Ch 32 reminded me of this meme.

Chapter 34

This chapter debunks the notion that the Federal Reserve is in any way libertarian just because Alan Greenspan was head of it once. Chapter 35 Debunks the myth that the Fed is in any way independent - Fed chairmen basically do the bidding of the president in order to maintain their jobs. President wants loose policy? President gets loose policy, and vice versa. I liked his discussion on the damage done by typical college economics textbooks, particularly Paul Samuelson's, which is most popular. Chapter 36 Explains how government caused the sub-prime mortgage meltdown. This is useful because people often try to blame DE-regulation when nothing could be further from the truth. As an aside, I found The Big Short an entertaining movie on the subject if you have not seen it, but it largely leaves unmentioned government as a cause and this chapter definitely fills in the blanks. Section 5 Chapter 47 Macroeconomists Discover Economics and Debunk the New Deal (Again) is probably the most intriguing to me. Seven decades of economists who have sold us the line that the New Deal and large-scale government spending is what got us out of the Great Depression. It took several decades but macroeconomic model builders, who consider themselves to be the elite of the economics profession, have finally discovered freshman-level principles of economics and have used that discovery to finally debunk FDR’s New Deal. (Beginning in the 1930s Austrian School economists like Henry Hazlitt recognized the truth about the New Deal: It made the Great Depression deeper and longer lasting.) The only wise thing to have done was to have allowed the liquidation of hundreds of overcapitalized businesses to occur, cut taxes and spending, and deregulate. Instead, the Fed increased the money supply by 100 percent in a failed attempt to create another bubble while the president and Congress implemented an explosion of government interventionism. That was the first time in American history that a depression was responded to with government interventionism rather than governmental retrenchment, and the result was a seventeen-year long Great Depression, the worst in history. The essay is solid and I'll need to look into Murray Rothbard's America's Great Depression to learn more. That mainstream macroeconomists and their modeling have come around against governmental interventionism during a depression is great. Now, if the citizenry can learn that before the next bubble pops. I foresee politicians and special interests will use the next crisis as an opportunity to line their pockets. CHAPTER 48 Will Socialism Make You Happier? The Trojan Horse of “Happiness Research”I hadn't heard of this statist argument before but basically "...statists around the world are changing their tune and saying that prosperity doesn’t really matter after all; what matters is how happy we are. And, they say, that is what government can be really, really good at—making us happy. Consequently, they argue, there should be no more limits on governmental powers, for limiting governmental powers will limit our very happiness." In the year this book was published, Bhutan was the 'Happiest' according to the UN-sponsored "World Happiness Report". Yes, Bhutan. This hellhole, ahem, I mean paradise: As an intelligence officer which has experience in this part of the world... No. This year's winner is Norway, which is much more beautiful and bearable.Source:WORLD HAPPINESS REPORT 2017 It's also a lot more socialist, which to be fair, is the point. It's edited by leftist academic Jeffrey Sachs of Columbia University, what else would you expect? As F.A. Hayek commented in The Road to Serfdom, the end of socialism was always egalitarianism; only the means changed over time, beginning with government ownership of the means of production and transforming to income redistribution through a welfare state and a “progressive” income tax. These happiness researchers never make any mention at all of the well documented pathologies created by welfare statism, such as the destruction of the work ethic, family breakup, the growth of dysfunctionality caused by a welfare state that removes people from the working population, etc. Thus, “happiness research” is part of a crusade to persuade the public that poverty and servitude to the state are superior to prosperity and freedom. It is a new version of what twentieth-century communists referred to as “socialism with a smiling face” during the last, dying days of totalitarian communism. Chapter 49 The Canard of “Asymmetric Information” as a Source of Market FailureGood information on the Nirvana Theory of Markets. I tried to look more into it, but it is unique to only this writing. Nirvana Fallacy— comparing real-world markets to an unattainable utopian ideal (perfect competition), and then denouncing markets because they fall short of utopia or Nirvana. Having “proven” that markets “fail,” the analyst then proposes government intervention under the assumption that no such failures will infect government. Markets may not be perfect, but government is assumed to be. Overall, I liked Section 5 the best. The ease at which he demystifies economic myths is extremely understandable. I just wish it was taken onboard by many voters who refuse to heed the empirical evidence against government intervention. Asymmetric information problem really applies to government not the free market: “In this case we are dealing with the well-established fact that, in their capacity as voters, people tend to be “rationally ignorant” of almost all of what government does. In fact, government is so pervasive that no human mind could possibly comprehend the tiniest fraction of one percent of what government in a country the size of the U.S. does. Consequently, special-interest groups dominate all democratic governments;” A related problem I think is that "public servants" are allowed to keep secrets from their supposed masters. Chapter 51 “Politicians perpetuate the myth of government job creation because the government jobs that are created are seen by the average voter, whereas the private-sector jobs that are destroyed (or never created) are not.” I.e. Hazlitt's seen and unseen as described in Economics in One Lesson Chapter 52 DiLorenzo shoots down the gender wage gap myth. Tom Woods has done a couple of shows on this subject as well, as I recall. Summary DiLorenzo lays out a decent criticism of how Government, corrupted by size and motive, has engaged in forceful and deceitful acts against the populace. To be honest, I really dislike collections of articles such as this and found in other "books". If an author is still alive, such collections are always better to be formed in to a true book that is able to cleanly explain a subject from start to finish. While DiLorenzo's articles are well written (and are quite often sourced with citations! Such a rarity among articles), the execution of the message would have been much better had he taken the time to write these out in to full chapters of their own. The topics covered in the book were good ones to discuss (though I think that the mentions of the Civil war would be better served in a separate book), but I do wish that the author had expanded more on the topics of taxation, subsidies, and the enforcement of victimless crimes. Overall a good read, and some articles were absolutely fantastic. If only the author could have written this out as an actual book and added another hundred pages or so, this could have been something especially fantastic. edit: I've decided to give the book 5 stars, from the original 4. I find that I often go back to the book to re-read certain articles when I come across various topics of discussion. I still wish that the author had written a proper book instead of just compiling a collection of his articles, though. Follow libertyLOL on your favorite social media sites:FacebookYoutube Tumblr Pintrest Countable: Government Made Simple Steemit blog on a blockchain Patreon Gab.ai libertyLOL's Liberty Blog RSS Feed We also run a couple twitterbots which provide great quotes and book suggestions: Murray Rothbard Suggests Tom Woods Suggests Jason Stapleton Suggests Progressive Contradictions MORE FROM LIBERTYLOL:

I have my own business. It's about as simple as a business can be. We want to hire our first employees. In case anyone has any doubt whatsoever about how much more difficult/worse the government makes things for employers and employees (excluding income taxes and 15.3% Social Security & Medicare taxes!), check this out: We have to worry about "wrongful termination." Federal, state, and city law prohibit discrimination/harassment on the basis of the following protected categories: Race, color, religion, creed, national origin or ancestry, ethnicity, sex (including pregnancy), gender (including gender nonconformity and status as a transgender individual), age, physical, mental, or perceived disability, alienage or citizenship, past, current, or prospective service in the uniformed services, genetic predisposition or carrier status, familial status, marital status, sexual orientation (including actual or perceived heterosexuality, homosexuality, bisexuality, and asexuality), partnership status, and victim of domestic violence status. We have to comply with the "Fair Labor Standards Act," NY labor law, and the NY minimum wage ($12/hour effective 12/31/17). We have to comply with the "New York Paid Family Leave Act," and the "NYC Paid Sick Leave Law." We've been advised by both an accountant and an employment lawyer that we must retain a payroll provider just to be able to keep up with the constantly changing government rules. We have to register with NY State as an employer. During the process, they ask questions that you literally can't know the answer to at the time you're registering. They also ask probing questions such as, "Does anyone work for you that you don't consider to be an employee?" And guess what? The guidelines around what constitutes an employee versus a contractor are so vague that a lawyer who specializes in employment and a lawyer who specializes in our field can't definitively advise us on what we can do to know whether we're complying with the law. We have to report to the NYS Department of Taxation and Finance, comply with the "Wage Theft Prevention Act," and the "Immigration Reform and Control Act." We have to purchase workers' compensation insurance, "NY State Disability Insurance," and "Unemployment Insurance," which "starts" as a 4-5% tax (you have to wait for the State to tell you after you register) and, presumably, goes up from there based on how well our company is doing. (There's also another business tax on top of everything else that kicks in once we hit some arbitrary amount of profit.) We need to deliver "workplace postings" to every employee, even though we don't have a physical office. There's a whole industry around this because the government doesn't even provide the information in any kind of easily accessible way. (Check out complianceposter.com for fun.) What a productive use of our time, energy, and the valuable resources we need to grow! I'm sure our customers love paying higher prices, since they have plenty of disposable income. I bet the people we hire actually prefer having chunks of money taken out of their pay before they get it, because they know they're going to get every inflation-adjusted dollar back someday, and more! Hey, at least we have a government making sure that we don't do anything "wrong." Otherwise we could lie, cheat, and steal, since that's how you succeed in business! And at least we have a government doing everything possible to encourage our business to grow so that we can create jobs and prosperity! Can't wait to discover what other nonsense we have to deal with. These things do nothing but hurt everyone involved. Follow libertyLOL on your favorite social media sites:FacebookYoutube Tumblr Pintrest Countable: Government Made Simple Steemit blog on a blockchain Patreon Gab.ai libertyLOL's Liberty Blog RSS Feed We also run a couple twitterbots which provide great quotes and book suggestions: Murray Rothbard Suggests Tom Woods Suggests Jason Stapleton Suggests Progressive Contradictions MORE FROM LIBERTYLOL:

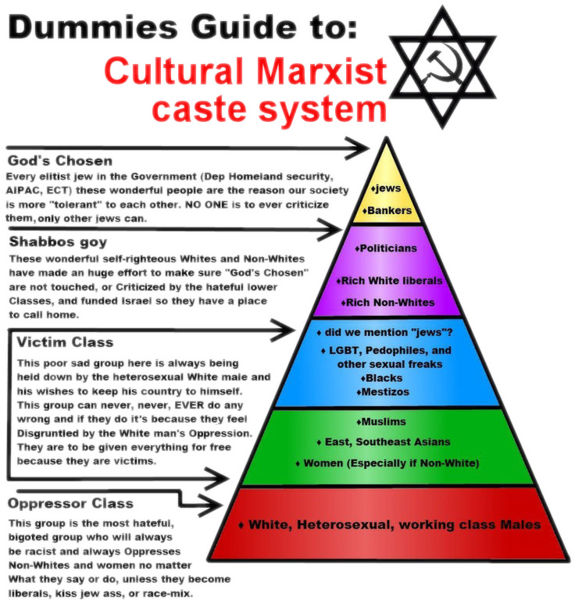

If you had to rank the most to least important issues to you in regards to liberty in the United States, how would you rank them?

A. US foreign policy, interventionism, war B. US Monetary Policy, The Fed, etc C. Govt spending, taxes, etc. D. Govt regulation and interference in the economy. (Min wage, ACA, etc) E. The War on Free Speech (if you don't know what this is, you're a hate-filled, racist, misogynist, xenophobe!) F. War on Drugs G. The "Cultural Marxist" threat (Image Below) H. Immigration I. States rights/Succession I. Energy Sustainability and Future Green/Renewable Policy J. "muh roads" K. Taco Tuesday only one day a week (Editor's Note: should be higher?) L. Climate Change M. Other (comment below) Let me know your order! Mine are in order. Cultural Marxism: Follow libertyLOL on your favorite social media sites:FacebookYoutube Tumblr Pintrest Countable: Government Made Simple Steemit blog on a blockchain Patreon Gab.ai libertyLOL's Liberty Blog RSS Feed We also run a couple twitterbots which provide great quotes and book suggestions: Murray Rothbard Suggests Tom Woods Suggests Jason Stapleton Suggests Progressive Contradictions MORE FROM LIBERTYLOL:

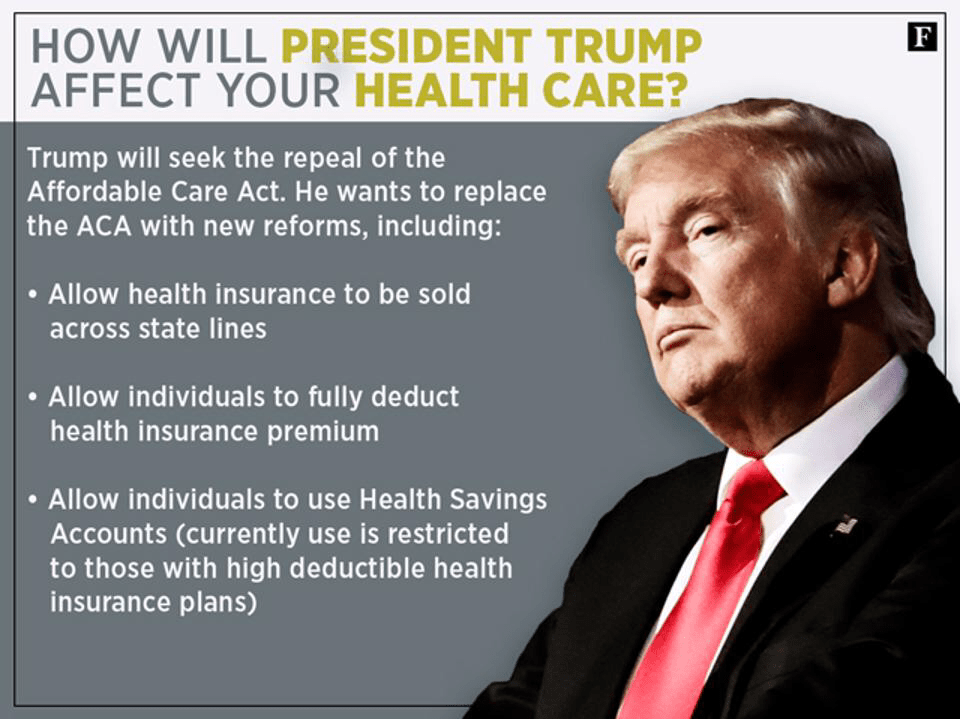

Do you remember what Candidate Trump's Healthcare Reform Plan looked like? I'll remind you that it was glorious. It was as if his campaign consultants hand-selected numerous Libertarian, free-market policies and listed them out in bullet points.

Anyone who has read Economics in One Lesson, or passed any Econ101 course cheered it. Unfortunately, it's long been forgotten. Of course it would necessarily be better than the current tripe which is funded by millions of dollars worth of insurance company lobbyists and currently debated on the Senate floor, but we won't even hear its merits debated in a public forum. Our legislation process has devolved intoyelling down one another with more and more politician's talking points. "Millions will Die" is obviously all that is needed to be said to defeat any change to the ObamaCare disaster. Not worth mentioning is other politician talking points such as "The average American Family will save $2500 annually under ObamaCare" and, of course, "If you like your doctor or plan, you can keep your doctor or plan."

An overview:

1. Completely repeal Obamacare. 2. Modify existing law that inhibits the sale of health insurance across state lines. 3. Allow individuals to fully deduct health insurance premium payments from their tax returns under the current tax system. 4. Allow individuals to use Health Savings Accounts (HSAs). 5. Require price transparency from all healthcare providers, especially doctors and healthcare organizations like clinics and hospitals. 6. Block-grant Medicaid to the states. 7. Remove barriers to entry into free markets for drug providers that offer safe, reliable and cheaper products. Either way, if you want to read a quick 4-page primer on health care reform, here it is. It's appealing because it was designed to lure you into voting for Trump. Unfortunately, once you're in power, ceding that power to the free market is a tougher task than any president can accomplish. President Trump should go back and demand legislators FULLY REPEAL ObamaCare and institute a concise version of this: Follow libertyLOL on your favorite social media sites:FacebookYoutube Tumblr Pintrest Countable: Government Made Simple Steemit blog on a blockchain Patreon Gab.ai libertyLOL's Liberty Blog RSS Feed We also run a couple twitterbots which provide great quotes and book suggestions: Murray Rothbard Suggests Tom Woods Suggests Jason Stapleton Suggests Progressive Contradictions MORE FROM LIBERTYLOL:

|

Search the

libertyLOL Archives: Archives

December 2020

Search and Shop on Amazon.com!

Tom Wood's Liberty Classroom"Get the equivalent of a Ph.D. in libertarian thought and free-market economics online for just 24 cents a day...."

At Liberty Classroom, you can learn real U.S. history, Western civilization, and free-market economics from professors you can trust. Short on time? No problem. You can learn in your car. Find out more! |