While Lobbying in and of itself is not illegal, it's effects on the free market can be damning. A recent commenter wanted more information on what exactly the FDA did to assist Mylan in achieving monopoly status.

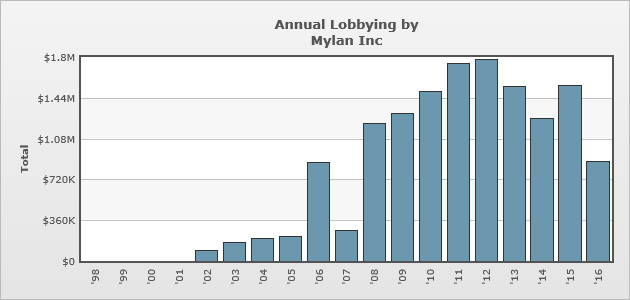

First we have to follow the money. We start when Mylan began pouring money into lobbying efforts and then look to pinpoint what effects they achieved. OpenSecrets.org is a primary repository to track campaign contributions to elected officials and candidates, companies, labor unions, and other organizations that spend billions of dollars each year to lobby Congress and federal agencies. Check out Mylan's page here. In 2007 the Mylan bought the rights to EpiPen, so we'll start there. Though it might be coincidental, their primary lobbying efforts began after the acquisition of Epipen, a four-fold increase from 2007-2008. Mylan's primary efforts went to bills such as:

Well, not exactly. A deeper look into these bills reveals that it made it even harder for generics to compete. The rules that Mylan lobbied for included the requirement that all Epipens be sold in packs of two, vice one. This expanded the volume of goods sold. A rule was inserted that required Epipens be prescribed for at-risk patients, not just those with confirmed allergies. This expanded the number of consumers to which the product could be marketed to. Rules were inserted which required public schools to maintain a stock of Epipens on hand, again, creating a market nationwide where it did not exist. No marketing or sales department necessary. Generics not approved by the FDA were not an approved item for school usage, thus preserving a monopoly throughout school districts nationwide. In 2013 the government passed a law giving block grants to the states to pay for the required stock in public schools. This effectively passed on all the costs of the previous rules to the taxpayers. Keep in mind, this is quite costly as the EpiPen only has a shelf life of about 12 months and must be replaced quite often. Once the FDA loosened health insurance rules on the usage of epipens, Mylan was emboldened to continue raising its prices because now the consumer didn't have to pay for it, the costs were passed on to the insurance companies. This phenomenon is called that the Third-Party Payer Problem and is an important concept to understand when trying to determine why health care prices rise. Mises.org wrote this morning that the problem isn't so much the dose, which is cheap, but the applicator: Epinephrine is extremely cheap—just a few cents per dose. The complications come from producing the easy auto-injecting devices. Mylan “owns” their auto-injector device design, so competitors must find work-arounds in their devices to deliver the epinephrine into the patient’s body. This task, coupled with the tangled mess of FDA red tape, has proven to be difficult for would-be EpiPen competitors. It’s like expecting somebody to come up with a new way to play baseball without bases, balls, gloves, or bats, but still getting the game approved by the MLB as a baseball game substitute. So why can't competitors compete? They've tried but the FDA red tape is a true obstacle. In March 2016, Fierce Pharma reported "FDA swats down Teva's EpiPen copy, putting Mylan in cruise control". Teva won't now be able to appeal and relaunch until 2017. The Pharmacy Times reported in 2010 that there were 3 brands of epinephrine auto-injectors are available on the market—EpiPen Auto-Injector, Adrenaclick, and Twinject. Adrenaclick, Twinject, and the authorized generic to Adrenaclick have an FDA Orange Book rating of “BX,” indicating that insufficient evidence exists to determine therapeutic equivalence. This rating indicates that these epinephrine auto-injector products are not therapeutically equivalent to each other. For example, the other products should not be substituted and dispensed when EpiPen Auto-Injector is prescribed, unless the prescriber is consulted and agrees to change the prescription. As a liberty-minded person, I believe that you can charge whatever you want for your product and for the fruits of your labor. But that assumes there is a free-market where a competitor can come along with market efficiencies and increased value and convenience for the customer and undercut you. The rest of this post is provided as information and without editorial.

Proxy filings show that from 2007 to 2015, Mylan CEO Heather Bresch's total compensation went from $2,453,456 to $18,931,068, a 671 percent increase. During the same period, the company raised EpiPen prices, with the average wholesale price going from $56.64 to $317.82, a 461 percent increase, according to data provided by Connecture.

"If you look at the facts here, when Mylan controls 85 percent of the market, to quote Bloomberg News, and they had this monopoly power drop in their laps and they went for it - that's what I see," she says. "They say they've made some improvements, but there's no way their improvements should be five times more the value of the item itself." mORE FROM lIBERTYlol:

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Search the

libertyLOL Archives: Archives

December 2020

Search and Shop on Amazon.com!

Tom Wood's Liberty Classroom"Get the equivalent of a Ph.D. in libertarian thought and free-market economics online for just 24 cents a day...."

At Liberty Classroom, you can learn real U.S. history, Western civilization, and free-market economics from professors you can trust. Short on time? No problem. You can learn in your car. Find out more! |