FREE BITCOIN! When you buy $100 Bitcoin through this link, you'll earn $10 of FREE Bitcoin! (IMMEDIATE 10% ROI!)

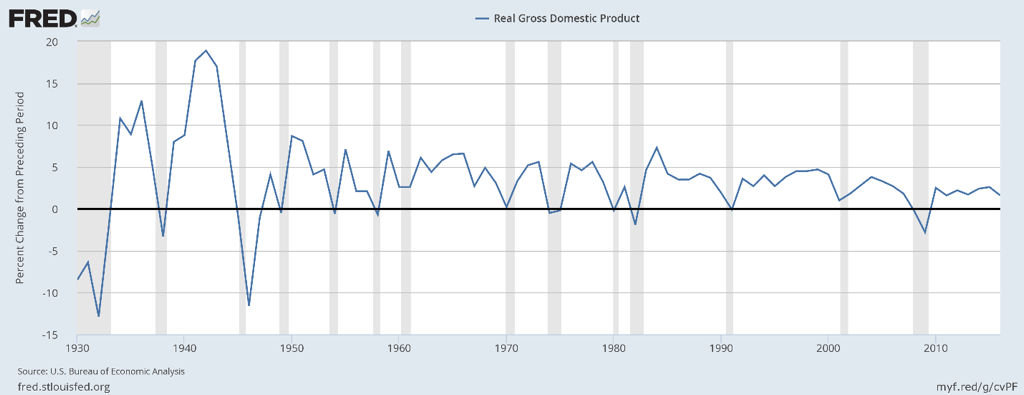

Growing the Economy Over the next couple of years, we predict the best global GDP growth will come from the United States. The powerful triad of lower taxes, deregulation and fiscal spending will move the US economy forward making it the proverbial locomotive that pulls the world economy. The Presidents goal is to get back to 4-5% annual GDP growth that we have seen in the past. Looking at the chart below over the last 85 years, the Obama economy was the worst recovery since the 1930s. If we can get back to the norm of a 4-5% recovery that will create a huge number of jobs.

Average recovery in past years has been 4-5%.

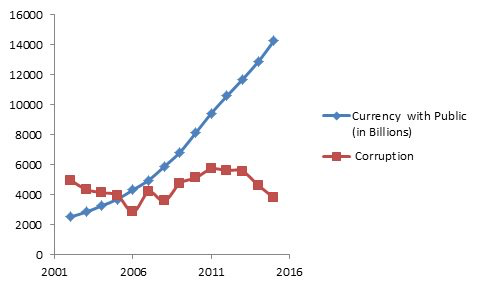

Overseas there are some dark clouds on the horizon that will affect our markets. The MaxOut Savings Report has been highlighting the dangers of China’s runaway growth. China’s growth over the last decade has been one massive debt bubble. During that time, credit has grown from three trillion dollars to over thirty-four trillion dollars. Over the last 18 months, China’s credit has increased six and a half trillion dollars, while deposits have only grown by three trillion dollars. Despite massive growth in bank credit the Chinese economy is in trouble and will be forced to confront President Trump because of the crisis. President Trump will be the first President to stand up to China over jobs likely causing a standoff in the South China Sea or a currency/trade crisis. When the US and China face off, expect volatility in the stock and bond markets. Ivory Tower Moves on Cash One of the craziest ideas we have ever seen is the war on cash. The war on cash is the theory that we need to eliminate cash currency to prevent corruption, tax evasion and terrorism. This idea has been generated by Harvard professors Ken Rogoff, Peter Sands and Larry Summers, under the guise of stopping terrorism and tax evasion. The “end cash” agenda was then pushed by the elite class at recent Davos Conferences. In case you think this is some moonbeam idea nobody takes seriously, take note that the EU has moved to eliminate the 500 Euro note. Furthermore India has called in all of their “large” notes (ten dollar notes) which has actually caused the Indian economy to crash. The Central Banks and their negative interest rate policies are the ones behind this “end cash movement”. If there is no cash - only electronic money - then it is very easy to force people to spend by installing negative rates on the electronic cash. In a negative interest rate world, a central planner (Central Banker’s) dream is that every day your money will lose some value unless you spend it and at the same time you boost tax collection. From the chart below, we can see that even as currency in circulation has grown, corruption has gone down. The idea that cash causes corruption is a red herring.

Posted By David Stockman’s Contra Corner

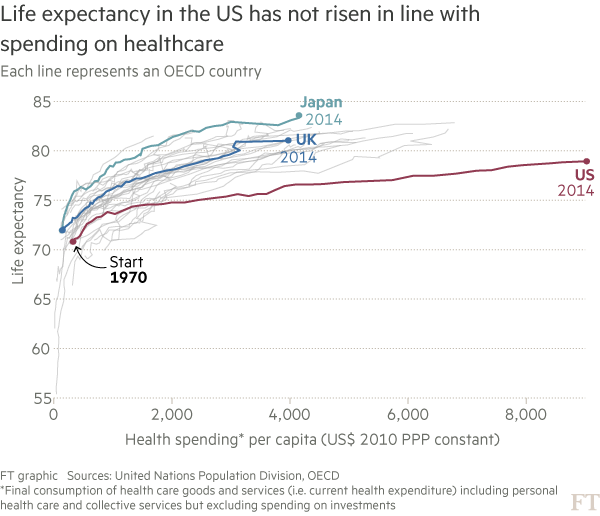

No correlation between cash and corruption The scary thing about the move to eliminate cash, is that in a crisis such as a hurricane or EMP attack the power could be out for a long period, leaving people without money and in severe trouble. Look what happened during Hurricane Ike in Houston when over three million people lost power, many for over a week. An EMP attack could cut power to parts of the United States for several weeks and people would have no money if it were all electronic currency. An additional concern with the elimination of cash is that allows monitoring of purchases by people, raising major privacy issues. The war on cash is a very real and a very dangerous idea that threatens the American people. It is an Ivory Tower idea that should be rejected. High Costs Low Life Expectancy? Obamacare has turned into a fiasco for the American middle class skyrocketing healthcare premiums and lessening the access to good quality physicians. The most outrageous thing about healthcare is the cost, as Americans pay more per capita for healthcare than almost every country in the world. The disturbing thing about our healthcare is that for all the money spent on healthcare our life expectancy is five to ten years less than many developed countries such as the UK and Japan. As we can see from the World Bank chart below, healthcare costs in the United States are the highest in the world and we have one of the lower life expectancies of any developed country.

Outlook

The recent move higher in the stock market since the Trump election has been based on expectations of a stronger economy. This will help the United States economy grow at a much faster pace than the rest of the world making us the locomotive that carries the rest of the world’s economy along. This will take time to implement. We face a looming trade confrontation with China and to a lesser extent Mexico, with resulting currency volatility. At the same time the Federal Reserve is on track for multiple interest rate increases for the first time in almost a decade. This will also increase volatility. Going forward valuations are at new record highs and will likely come down as that all plays out. Near-term, a rapidly forming concern is the hysteria by the media and Democrats with the Donald Trump Presidency. There is an old saying, “a house divided against itself cannot stand” to quote Lincoln and Mark 3:25. The same thing can be said for the nation’s stock market. If the Democrats succeed in shutting down or delaying reform, the stock market is in real trouble. We have had a good run since the election, but now is a time for caution. Follow libertyLOL on your favorite social media sites:FacebookYoutube Tumblr Pintrest Countable: Government Made Simple Steemit blog on a blockchain Patreon Gab.ai libertyLOL's Liberty Blog RSS Feed We also run a couple twitterbots which provide great quotes and book suggestions: Murray Rothbard Suggests Tom Woods Suggests Jason Stapleton Suggests Progressive Contradictions MORE FROM LIBERTYLOL:

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Search the

libertyLOL Archives: Archives

December 2020

Search and Shop on Amazon.com!

Tom Wood's Liberty Classroom"Get the equivalent of a Ph.D. in libertarian thought and free-market economics online for just 24 cents a day...."

At Liberty Classroom, you can learn real U.S. history, Western civilization, and free-market economics from professors you can trust. Short on time? No problem. You can learn in your car. Find out more! |